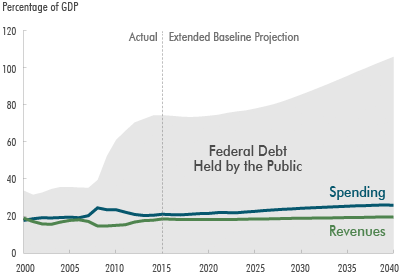

Federal Debt to Exceed 100 Percent of GDP by 2040

Do ya think it's time to rein in the spending a tad?

Sen. Rand Paul (R-Ky.) wants to "blow up the tax code and start over," but the bloated government edifice supported by those taxes could use a little demolition too. The Congressional Budget Office's 2015 Long-Term Budget Outlook is out, and the takeaway is "If current laws remained generally unchanged, federal debt held by the public would exceed 100 percent of GDP by 2040 and continue on an upward path relative to the size of the economy—a trend that could not be sustained indefinitely."

The phrase "could not be sustained indefinitely" is a phrase that appears again and again in CBO documents. Translated, it means, roughly: The bill is coming due, assholes.

That's because the soaring national debt is not a new thing, nor are warnings about it and its nasty effects on Americans' prosperity. Those effects include displacing private investment, resulting in lower productivity and reduced income, even as the cost of paying the government's bills soar. That means a poorer, more constrained country.

The federal government has spent more money than it takes in for years. The deficit has shrunk and grown a bit during that time based on specifics of policy and the economy, as have projections of just how much the debt will pile up inthe years to come. But nobody has yet seriously suggested that revenues and spending will match up anytime soon.

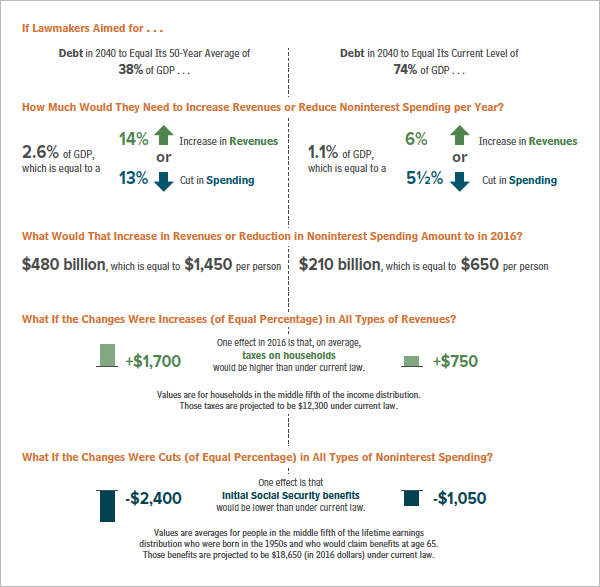

In the latest outlook, the CBO does offer some suggestions for avoiding a mass national drowning in a sea of red ink, just in case politicians are short of ideas. To maintain national debt at the current 74 percent of GDP, the feds would have to "slash" spending by 5.5 percent or increase revenues by 6 percent. To return the national debt to its 50-year average of 38 percent of GDP, the feds would have to actually reduce spending by 13 percent or increase revenues by 14 percent.

Yes, the idea of actually reducing spending causes much rending of garments in Washington, D.C., but it's been less than catastrophic when done in other countries. Canada "slashed total spending 10 percent in just two years and then held it roughly flat for another three years" in the mid-1990s without being reduced to a post-apocalyptic wasteland, points out the Cato Institute's Chris Edwards.

Politicians, by and large, will probably prefer to look at the revenue-raising side of the equation, because there can't possibly be anything to cut in the budget. But there's less wiggle room there. With the occasional surge, revenue has topped out at an average of 18 percent of GDP since the middle of the last century. Maybe thefeds can squeeze more blood from the stone, but that's not what history suggests is going to hapen.

And honestly, there's plenty to cut from the oversized federal government. Let's start with agencies that are lousy at their jobs, or those that can't hold on to sensitive data without handing it to the first hacker who asks…

Note: As commenters have pointed out, some measures of debt have the federal government already exceeding that 100 percent threshold. The St. Louis Federal Reserve Bank puts total public debt at 102.76 percent of GDP in the first quarter of this year.