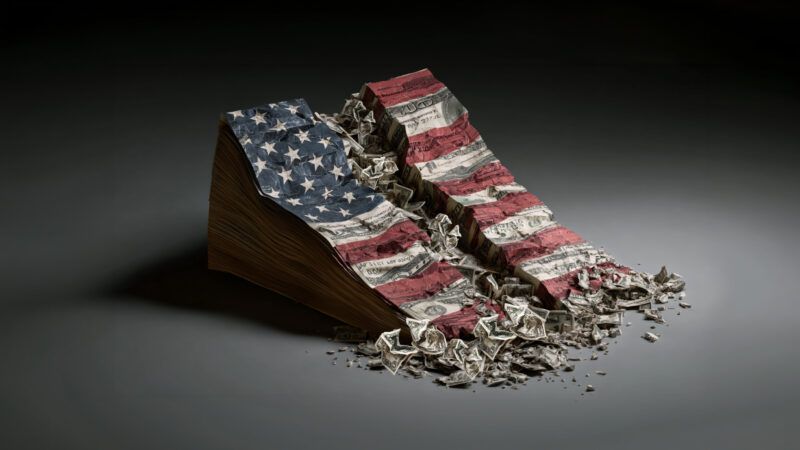

Interest on the National Debt Will Cost $16 Trillion Over the Next 10 Years

A new Congressional Budget Office outlook expects entitlement spending and the national debt to explode in the next decade.

Increased spending on old-age entitlements and the cost of financing the national debt will push annual budget deficits from $1.9 trillion this year to over $3 trillion by 2036.

That's according to the Congressional Budget Office's (CBO) latest 10-year budget estimate, released Wednesday morning. Over the next decade, the CBO expects the national debt to hit a record high of more than 120 percent of America's gross domestic product, exceeding the previous high of 106 percent near the end of World War II.

Much of that new borrowing will occur despite an anticipated increase in federal revenue, which the CBO expects will increase from about $5.6 trillion this year to $8.3 trillion by 2036. That increase in revenue is completely swamped by a projected rise in government spending, which will surge from about $7 trillion this year to over $11.4 trillion by the end of the 10-year budget window.

Nearly all of the expected increase in spending is a result of entitlement spending and the rising cost of servicing that massive pile of debt. The federal government will spend over $1 trillion on interest payments this year, and the CBO expects those interest payments to more than double over the next 10 years.

Over the course of the 10-year budget window, the federal government will spend an estimated $16 trillion on interest payments—that's $16 trillion in taxes that won't buy taxpayers any new government services but will merely pay the tab run up in previous years.

The major tax bill that Republicans passed and President Donald Trump signed last year will contribute to the worsening fiscal picture. The CBO estimates that policy changes implemented by the One Big Beautiful Bill Act will add about $100 billion to the deficit this year and about $1.4 trillion to cumulative deficits over the next decade.

On the other hand, higher tariffs imposed by the Trump administration will increase revenue by an estimated $3 trillion over the next decade, if they remain in place.

"The CBO's projections remind us that our fiscal trajectory remains unsustainable," Dominik Lett, a fiscal policy analyst at the Cato Institute, said in a statement. "This reckless borrowing has real, tangible costs for Americans, creating inflationary pressure, slowing economic growth, and making borrowing more costly."

Indeed, studies have linked higher debt to rising interest rates and persistent inflation. Higher interest rates or higher inflation could, in turn, worsen the CBO's already bleak projections. The 10-year budget outlook released Wednesday assumes that inflation will stabilize at 2 percent (it is currently 2.7 percent) and that interest rates will fall in the coming years. Fiscal hawks have been warning for years that unforeseen spikes in inflation—like the one that hit after the pandemic—or other emergencies would expose the federal government's precarious fiscal position.

Maya MacGuineas, president of the Committee for a Responsible Federal Budget, a nonprofit that advocates for reducing deficits, said in a statement that the new CBO report contains no "bright spots of encouraging news."

"A healthy balance sheet is critical for a growing economy, national security, and the ability to respond to unforeseen emergencies," she added. "At this moment in time with challenges ranging from the aging of society to growing geo-political rivalries, it is nothing short of self-sabotage to operate with such a self-imposed disadvantage."