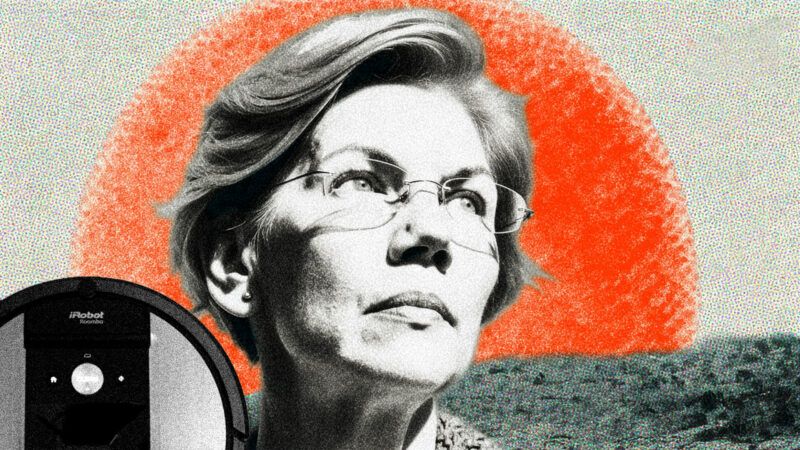

iRobot Faces Bankruptcy After Elizabeth Warren Helped Kill $1.65 Billion Amazon Merger

Amazon, with its deep pockets, could have helped turn things around. Instead, regulators consigned the company to die a slow and painful death.

A struggling American manufacturer may soon face bankruptcy. This was not just the result of low sales, but of government regulators butting in.

Online retail giant Amazon announced in August 2022 that it had agreed to purchase iRobot, makers of Roomba robot vacuums, for $1.65 billion. The acquisition would expand Amazon's footprint in the smart home market, after it previously purchased video doorbell company Ring.

The following month, the Federal Trade Commission (FTC) opened an investigation into the merger. Sen. Elizabeth Warren (D–Mass.) and several Democrats in the House of Representatives sent a letter to then-FTC Chair Lina Khan, saying "the FTC should use its authority to oppose the Amazon–iRobot transaction."

The letter alleged that rather than compete directly with iRobot—whose products accounted for 75 percent of the smart vacuum marketplace at the time—Amazon was simply trying to buy its way in. "Rather than compete in a fair marketplace on its own merits," the lawmakers warned, "Amazon is following a familiar anticompetitive playbook: leveraging its massive market share and access to capital to buy or suppress popular products."

The European Commission—the governing body of the European Union—soon launched its own investigation. Commissioners later signaled that, among their objections, a merger "may restrict competition in the market for robot vacuum cleaners."

"Amazon may have the ability to foreclose iRobot's rivals," the commission added, either by excluding them from its online marketplace or by "degrading their access to it."

In January 2024, Amazon and iRobot jointly announced the termination of the deal, seeing "no path to regulatory approval in the European Union." iRobot then announced it would cut 31 percent of its workforce; the company had hemorrhaged money while waiting for the deal to close, and it reported losing as much $285 million the previous year.

Since then, its outlook has not improved. "There is substantial doubt about the Company's ability to continue as a going concern for a period of at least 12 months," iRobot announced in March.

"Last week the last remaining counterparty to a potential sale transaction withdrew from the process following a lengthy period of exclusive negotiations, and we currently are not in advanced negotiations with any alternative counterparties to a potential sale or strategic transaction," it noted last week in a regulatory filing. If things don't improve, "we may be forced to significantly curtail or cease operations and would likely seek bankruptcy protection."

After this news broke, iRobot's stock price fell 33 percent. If the company went under, as ZDNet reported earlier this year, "existing Roomba models would continue to work, but they would be offline and function in a limited manner." Owners of its products—50 million sold worldwide, according to the company—would be unable to get product support, replacement parts, or software updates.

Of course, companies fail all the time, leaving customers in the lurch with any tech support or warranty issues. But this story is a bit different, in that iRobot had a path back from bankruptcy that government officials ruined.

While Amazon and iRobot blamed Europe for scuppering their deal, U.S. regulators played a part: Margrethe Vestager, European Commission executive vice president in charge of competition policy, said in a statement after the termination of the deal that the commission was in "close contact" with the FTC during the investigation. Nathan Soderstrom, FTC associate director for merger analysis, said the FTC was "pleased that Amazon and iRobot have abandoned their proposed transaction."

And Warren and the other lawmakers must have been pleased that, as they asked of the FTC, a regulatory body prevented the deal from going through. (Notably, iRobot is headquartered in Massachusetts, Warren's home state; if the company shuts down, a substantial portion of those who lose jobs could be her constituents.)

But who cares if Amazon did buy iRobot and put Roomba at the top of all search results? People are still free not to buy them, or to go somewhere else. Grocery stores routinely prioritize their own private label products, which carry higher profit margins. And while iRobot was certainly the innovator in the space, dozens of companies now make and sell their own robot vacuums.

Besides, Roomba is no longer the dominant force it once was. "While iRobot…maintains its leading position in the North America, its global shipments decreased by 6.7% in 2024, and its market share fell by 2.6%, resulting in an overall share of 13.7%," Paul Lamkin wrote at Forbes in March. "The company has struggled to keep pace with the rapidly evolving competitive landscape," and "there are concerns as to whether [its new product lineup] will be enough to reverse its current trajectory."

It's no secret why: Other companies simply make better products. On its list of the best robot vacuums, Wirecutter makes a point to explain "why we don't currently recommend vacuums from iRobot," citing poor functionality and "rampant" complaints about the company's customer service. (It recommends offerings by Roborock and Eufy, brands that have launched in the last decade or so.)

Perhaps an acquisition could have improved the product line, with Amazon—which recently reported free cash flow of $31 billion—able to invest heavily in R&D. Instead, iRobot was forced to die a slow and painful death because government regulators thought they knew better than consumers.