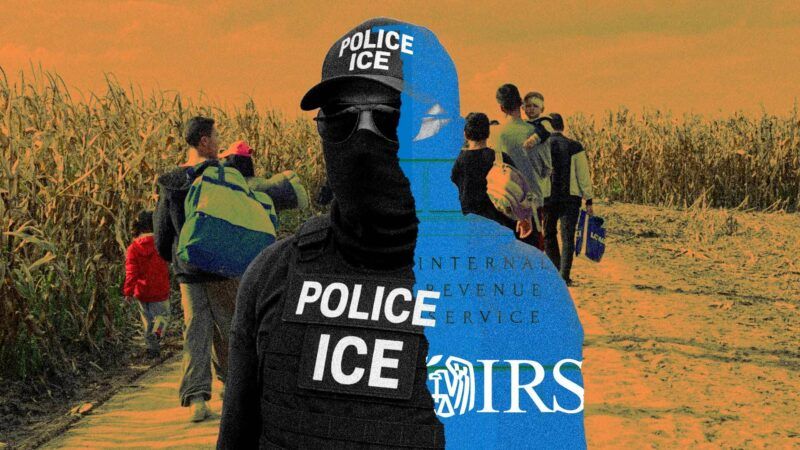

Leaked Blueprint Reveals ICE Plan To Use IRS Data To Increase Detentions

ICE wants to access confidential IRS data to locate tax-paying undocumented immigrants and boost detention numbers.

Shortly after taking office, President Donald Trump and his administration began pushing the IRS to share taxpayer data to aid in identifying undocumented immigrants. Leaked documents reviewed by ProPublica reveal that an automated system is under development to share data with the Department of Homeland Security (DHS) and Immigration and Customs Enforcement (ICE), despite the agency's concerns over Americans' privacy.

Of particular interest to the Trump administration are up-to-date addresses of individuals it seeks to detain for immigration-related reasons to meet a quota of 3,000 arrests per day. Under the leaked blueprint, the DHS would be required to submit a request for the names and previous addresses of targeted individuals, along with "the date of a final removal order, a relevant criminal statute ICE is using to investigate the individual, and the tax period for which information is sought," reported ProPublica. The automated system would then try to match the information to a taxpayer identification number, access the associated tax file, and pull the individual's address from the most recent tax period. Names provided by the DHS that lacked required information would be rejected, and no match would be made. Those familiar with the matter said the system may be launched by the end of July.

One of the most obvious risks with this system is that innocent people could be targeted. Having no way to verify the DHS's information, the IRS would have to assume the information provided is accurate and the criminal investigation is valid. Technical experts and IRS engineers who reviewed the documents told ProPublica that "the system could easily be expanded," and without limitations to what and how many times DHS can request data, it could potentially provide more "than just a target's address…including employer and familial relationships."

In April, the IRS negotiated with DHS a "memorandum of understanding" and put in place guardrails to safeguard Americans' private information to quell rising tensions over the legality of taxpayer data-sharing. After all, the unauthorized disclosure of taxpayer return information is a felony offense that carries a penalty of up to a $5,000 fine and 5 years in prison. But in an email reviewed by ProPublica, Andrew De Mello, the IRS's acting general counsel, rejected ICE's request for 7.3 million taxpayer addresses for failing to meet legal requirements, and was forced out of his job two days later, according to people familiar with the matter.

The request for an automated system to provide millions of confidential tax records, protected by strict privacy laws, is unprecedented and a break from the former policy that allowed for IRS oversight and limited transfer to other agencies. Despite the potential for abuse, a White House spokesperson told ProPublica the "planned use of IRS data was legal and a means of fulfilling Trump's campaign pledge to carry out mass deportations of 'illegal criminal aliens.'"

The new system would turn the IRS into an immigration enforcement arm while reversing a long-standing policy that protected undocumented immigrants from deportation to encourage them to pay their taxes, risking an estimated $300 billion of tax revenue over the next decade. While the system might be intended to help ICE identify undocumented immigrants today, it could soon be used to snoop on citizens and put all Americans' privacy at risk.