As 'Tariff Man' Attacks Stock Market, Justin Amash's 'Liberty Man' Is the Hero We Need

Tuesday's tweets demonstrate that Trump still doesn't understand that Americans, not foreigners, are paying his tariffs.

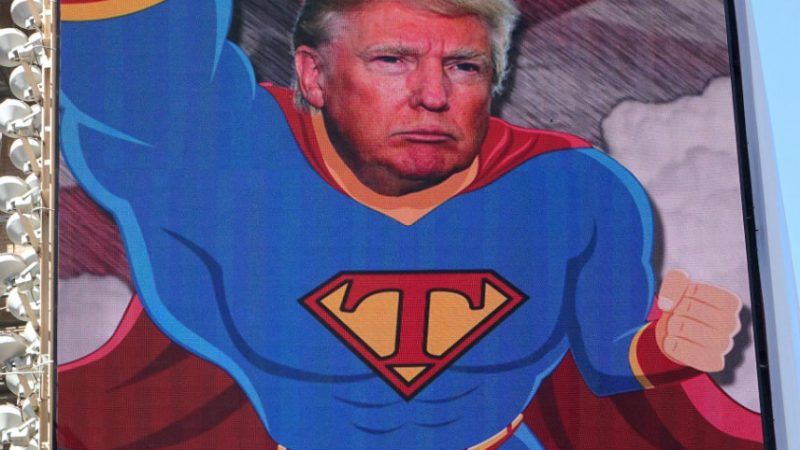

Amid a series of morning tweets that seemed to contradict his administration's claims about a supposed trade deal between the U.S. and China, President Donald Trump declared himself to be "Tariff Man."

The internet had a lot of fun with that one.

The stock market was less enthused.

This is carnage. The Dow is off nearly 700 points https://t.co/ERocieW14r pic.twitter.com/3Bwd8qNLpm

— Joe Weisenthal (@TheStalwart) December 4, 2018

U.S. markets rallied on Monday following the Trump administration's claim of an imminent truce in the U.S.-China trade war, only to fall sharply on Tuesday as presidential tweets and contradictory messages from senior administration officials indicated that the "deal" might be less firm than previously thought. The Dow finished the day just a hair over 25,000 points—meaning that the stock market has been basically flat since March 1, when Trump announced the first round of tariffs and the Dow was sitting at 24,600 points.

As I noted yesterday, the agreement between Trump and Chinese President Xi Jinping seemed to be little more than a series of vague goals with no concrete timeline or definitive way to measure progress. According to details released by the White House, Trump agreed to postpone a planned January 1 escalation of tariffs on Chinese goods for 90 days, while Xi agreed to buy more American agricultural goods in the meantime. The deal is, at best, really just an agreement to keep talking—a significant enough achievement after months of icy relations between the two major trading partners, but hardly an indication that the trade war is winding down.

Even so, Trump is once again going to under-perform even the lowest of expectations. On Tuesday, the president questioned "whether or not a REAL deal with China is actually possible"—throwing cold water on the hopes that it was the first step towards a trade war truce. Trump also repeated the threat of imposing more tariffs on China after the 90-day deadline expires.

Meanwhile, Trump's own top economic advisers seem confused about exactly when that 90-day period would begin and end.

Larry Kudlow, head of the White House's National Economic Council, added to the confusion when he said on Monday night that there was not a "specific agreement" that would lead to China lifting its tariffs on American cars—directly contradicting Trump's tweet earlier on Monday that claimed, "China has agreed to reduce and remove tariffs on cars coming into China from the U.S."

Jokes about "Tariff Man" aside, Tuesday's tweets demonstrate that Trump still doesn't understand that it is American consumers and businesses that pay his tariffs—not China, not Chinese exporters, and not people or business that "come in to raid the great wealth of our Nation," whatever the president means by that. This fundamental misunderstanding of economics, combined with his reckless announcement of the detente that wasn't, scared investors and continues to undermine his administration's efforts at reaching a real trade deal with China.

If the stock market continues to slide and prospects of a deal with China prove fleeting, Congress may finally be motivated to take action against Trump's unilateral power to set trade policy. Already this week, Sen. Chuck Grassley (R-Iowa), chairman of the Senate Finance Committee, has suggested to Axios that he would support legislation that limits the president's ability to impose tariffs.

Lacking that, we may need a hero to stand against the threat of Tariff Man.

I am a Liberty Man. Trade is not raid. Voluntary exchanges make Americans wealthier. @POTUS's tariffs, which create barriers to exchange, are paid for by Americans. Taxing Americans to steer our decisions is social engineering that reduces our economic power and makes us poorer. https://t.co/j2rsiN4l8n

— Justin Amash (@justinamash) December 4, 2018