The Budget Revolution That Wasn't

If you believed candidate Ronald Reagan in 1980, you should have seen federal spending of $760 billion last year. Instead, it was $842 billion. Any guesses about 1988 spending?

In Washington, the lengthy budget festivities are well under way. President Reagan is seeking essentially to freeze total federal spending next year at the 1985 level. He's come up with an attractive list of budget cuts—the Small Business Administration, the Export-Import Bank, food stamps, Urban Development Action Grants, the Economic Development Administration, Amtrak, agricultural price supports, and the like. And this isn't all. In his inaugural address, Reagan pledged to "take further steps to permanently control government's power to tax and spend."

But we've heard all this before. Four years ago, Reagan promised an end to "waste, extravagance, abuse and outright fraud" in federal spending and pledged a balanced budget. Revolutionary fervor swept the capital. Meg Greenfield wrote in Newsweek that "you can mark down the first two weeks in February as the time when people all over this city—not just those ritually opposed to domestic budget cuts, but also those ritually and noisily in favor of them—looked at each other with disbelief and said, with shared alarm, 'My God, what if he isn't kidding?' " And Reagan wasn't, or so it seemed, when he targeted nearly 300 programs for total spending cuts of $49 billion just in fiscal year 1982 (October 1981 through September 1982).

But by the end of Reagan's first term, the old revolutionary fervor had come to naught. His zeal to cut the budget had disappeared. Last year, in fact, the government spent nearly half again as much in nominal dollars as it spent under President Carter in 1980. Washington gobbled up a quarter of the country's GNP (gross national product) in 1983, which is a peacetime record. And that percentage is not expected to drop back to its 1980 level before the end of Reagan's second term, if then.

It's interesting that despite all this, both Reagan and his most bitter political opponents claim that he has changed America's budget landscape dramatically by cutting spending. Reagan himself issues proclamations about "near-revolutionary" budget austerity, while former Rep. Shirley Chisholm (D–N.Y.), for one, has charged that spending cuts have shredded the "social safety net." Both are wrong. The austerity has been largely imaginary, and domestic spending (which is what Chisholm tacitly equates with the "safety net") is actually higher now than before Ronald Reagan took his first oath of office.

Measuring the Extravagance

In order to understand just what has happened so far under Reagan, it's useful to recall that budget savants use a special lexicon. Their technical terms include nominal spending, which means the face value of the federal budget, and real spending, which is the nominal amount adjusted for inflation. More important, though, is the political jargon. A "budget cut" is only rarely what most human beings would think of as a cut. Usually, "cutting the budget" means spending more money and only slowing the rate at which the budget is expanding.

With the proper terminology under our belts, we can turn to Reagan's record. There are many ways to assess that record, but it is most revealing to compare 1984 spending levels with:

• the budget in 1980, the year before Reagan took over;

• Jimmy Carter's proposed 1984 budget, which was drawn up before he left office in January 1981;

• the amount that Reagan's own Office of Management and Budget (OMB) says would have been spent last year if no cuts had been made;

• the 1984 budget that Reagan himself proposed during the 1980 campaign; and,

• the 1984 spending levels that he first proposed after taking office.

Let's look at them one by one.

The federal government spent $577 billion in 1980, Carter's last year in office. As huge as that amount is, it's still considerably less than the $842 billion in total outlays in 1984. Now, those are nominal figures—but even in real, inflation-adjusted terms, outlays grew an average of 3.4 percent annually during Reagan's first term of office, not much better than Jimmy Carter's 3.9 percent.

At the same time, Carter's record was substantially better in another important respect. The portion of the GNP absorbed by government increased in Reagan's first term by 1.6 percent, but under Carter, it edged up by only 0.2 percent.

So by the first measure, Reagan's record is not all that good. How about the second measure—Carter's lame-duck budget proposal for 1984? There are no laurels for Reagan there, either. In real spending, Reagan exceeded by 15.6 percent the spending that Carter had envisioned (although in fairness to Reagan, one should remember that Carter exceeded his other budget estimates).

Judged by the third standard, the Reagan record looks a bit better. The OMB has run an analysis—with the latest unemployment, inflation, and GNP forecasts—to project what spending would have been in 1984 by the "pre-1981 baseline." In other words, it calculated what the government would have spent under the Carter budget if neither the White House nor Congress had acted in any way to slow spending growth.

Without any of Reagan's budget initiatives, the OMB calculated that total spending would have been $51 billion higher in 1984. But in real terms, that success was less than dramatic: after accounting for inflation, Reagan reduced outlays from the pre-1981 baseline by only 0.4 percent. And even that figure is dubious, because it makes the unrealistic assumption that Carter in a second term would not have acted in any way to cut the growth of spending.

The fourth measure is one that Reagan devised for himself. In September 1980, Reagan unveiled his "Strategy for Economic Growth and Stability in the 1980s." He set as his goal "to bring about spending reductions of 10 percent by fiscal year 1984," which would result in expenditures of $760 billion. But when 1984 came along, he hadn't even come close. Spending for 1984 actually was more than $80 billion higher than Reagan's campaign target, a 10.8 percent overflow.

Reagan devised the fifth measure as well—this time, shortly after he entered the White House. In March 1981, Reagan sent Congress a package of budget cuts designed to reduce projected spending in 1984 by $81 billion. Two months later, he released proposals to reduce spending for Social Security an additional $11 billion through 1984. With the combined programs, Reagan's spending target for 1984 was $759 billion, a level slightly below his most optimistic 1980 campaign pledge. But the $842 billion spent by Uncle Sam last year was 10.9 percent above that 1981 goal. In real terms, the gap is bigger, since the 1981 proposals assumed more inflation in 1984 than actually occurred.

So, by four of the five measures, Reagan's budget-cutting policies have been a flop. And even by the only measure that makes him look good, the OMB projection, his record is not all that impressive.

A Billion Here, A Billion There

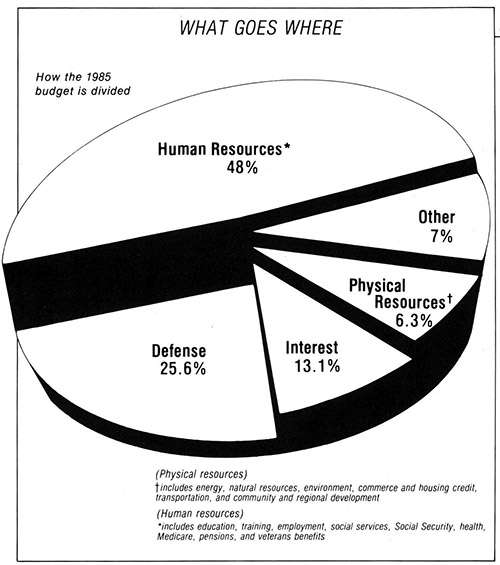

Much of Reagan's difficulty in slowing, let alone controlling, federal spending derives from the way different components of the budget work, their relative sizes (see chart, p. 40), and how he treats them.

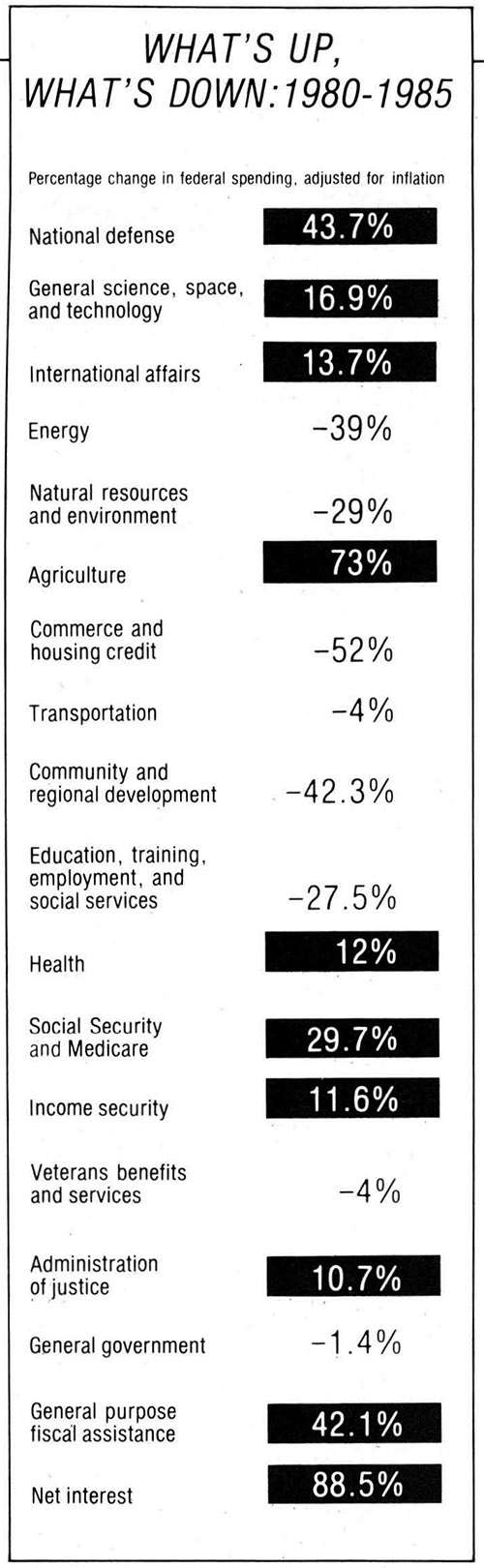

One component is interest payments on money the government has borrowed over the years in lieu of raising taxes or spending less. These payments make up about an eighth of the budget. They can be slashed only by retiring some of the national debt—but that requires other spending cuts or tax increases or both. Interest payments are increasing at an alarming pace. They've already doubled in nominal terms since 1980, when they were $52 billion, and the administration expects them to climb to $148 billion next year. The increase in real terms from 1980 to 1985 is 88.5 percent.

Another big component of the budget is military spending, which consumes more than a fourth of the budget. There's certainly no progress there. On the contrary, if there has been any consistent theme to the Reagan administration, it has been to increase defense outlays. Reagan has already increased nominal military spending from $134 billion in 1980 to $227 billion last year. Even in real terms, that hike is an enormous 35.3 percent.

Despite the size of those increases, they actually reflect only part of Reagan's real long-term impact on military spending. He has not only increased spending on the Pentagon today. He has locked in higher military spending for the foreseeable future by getting Congress to approve large increases in total "budget authority" for new weapons, which will be spent over a number of years. The Congressional Budget Office (CBO) reports that the portion of the military budget going to weapons procurement will climb from 26 percent in 1981 to 38 percent in 1987.

So, it will be increasingly difficult for future presidents or congresses to reduce outlays, since they would have to cancel ongoing projects to do so. In fact, OMB Director David Stockman confessed to Fortune magazine last year that "there is a certain inevitability to it all. The major systems have been launched, mission and policy objectives have been approved, the force structure of our armed forces has been raised, so there are not a lot of things that can give way."

There is also a category of federal programs considered "defense-related." These are nondefense programs that serve a military function, such as strategic stockpiles of resources such as oil and "foreign security assistance" (military aid). Reagan increased funding for these "national interest" programs, as OMB terms them, to $32 billion last year—24.8 percent more in real terms than in 1980.

Then there's social spending. When Reagan first announced his budget program, Sen. Howard Metzenbaum (D–Oh.) denounced it as "a perversion of justice" for the middle class. Metzenbaum need not have worried. The middle class is one of Reagan's biggest constituencies, so its welfare programs—particularly entitlement programs like Social Security, Medicare, and federal retirement benefits—were protected from big cuts as part of the "social safety net." Indeed, they weren't just protected from cuts. Spending for these programs rose from $185 billion in 1980 to $279 billion last year, for a jump of 17.3 percent in real terms.

While the middle class has faithfully supported Reagan, the beneficiaries of means-tested welfare programs (based on need) have never been a Reagan constituency. The administration has pushed harder to reduce federal spending for means-tested welfare programs, such as Aid to Families with Dependent Children and food stamps, than for entitlements benefiting the middle class. Nevertheless, means-tested welfare spending still climbed from $47 billion in 1980 to $65 billion last year, a 7.4 percent rise in real terms. The most Reagan has done is slow the rate of spending increase.

For some budget items, real spending under Reagan has declined. Examples include veterans benefits—but not because of Reagan's budget-cutting prowess. The number of veterans eligible for educational benefits was shrinking (spending on veterans has actually been declining since 1976).

There are victories for which Reagan can claim credit, chiefly in areas of discretionary spending. For example, after nearly quadrupling in real terms from 1962 to their peak in 1980, handouts to state and local governments and to private businesses have been cut by about half in real terms in four years. Even spending on "infrastructure"—the pork-barrel outlays for highways, water projects, and mass-transit systems that Congress loves—has been slashed substantially. And the "overhead" for government, which includes the administrative costs of regulating business, gathering statistics, collecting taxes, and so on, has been cut (even though IRS and law-enforcement spending has risen sharply).

Every success in budget cutting, however, is more than outweighed by a failure. Agriculture is one of the dismal tales. Spending on price supports and rural-development subsidies, for example, has increased from less than $9 billion in 1980 to more than $20 billion this year (in 1982, spending hit a record of almost $23 billion). And it is the really gargantuan categories of spending where Reagan's record has been less than stellar that make his successes look very paltry indeed.

Culprits Galore

Whose fault is it? There is, not surprisingly, enough blame for everyone.

The economy, which performed more poorly during Reagan's first term than the administration says it expected, is partly at fault. The recession increased unemployment-compensation payouts and outlays for farm-price supports. Meanwhile, higher interest rates and larger deficits pushed up interest costs.

But the economy can be used as a scapegoat only up to a point. After all, inflation was lower than expected. This reduced some outlays, particularly for indexed programs. At the most, the economy is responsible overall for pushing expenditures some $25 billion above Reagan's goal.

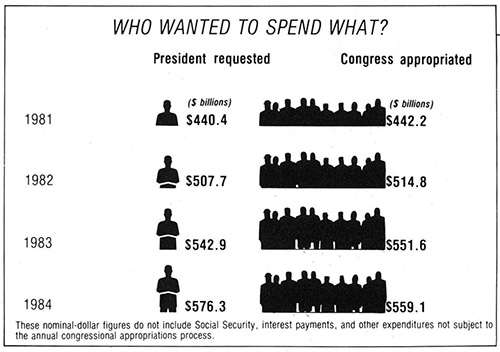

But that's only about a third of the $82-billion spending overflow. The other $57 billion of the 1984 "budget gap" is nothing but overspending, pure and simple. Who is most at fault there? Reagan says Congress, accusing it of turning down close to half of the domestic cuts that he requested for 1984, worth some $53 billion. Had those cuts been adopted, Reagan claims he would have nearly hit his target.

That may be true, but Congress made up for its extravagance on the domestic side by denying the Reagan administration some $20 billion in military and military-related outlay increases that it requested.

There's another flaw in Reagan's rhetoric. Not all cuts are created equal. To shift the blame to Congress, Reagan has lumped together all the program cuts he ever proposed—including those like the initial Social Security plan that had, in the words of one budget official, "a half-life of a week." Indeed, many of the Reagan cuts were proposed in one budget and subsequently dropped. Others, like reductions in Export-Import Bank funding, were explicitly reversed. And the administration did not fight equally hard even for the cuts it stood by.

And despite Reagan's claims, the difference between overall administration requests and congressional appropriations in the last three years has not been significant (see chart above). Indeed, the total congressional increase above Reagan's spending requests from 1982 to 1984 was only 0.6 percent of the total budget, and Congress appropriated $17 billion less for 1984 than he requested. They made a considerable cut in the proposed budget authority for the Pentagon, and they even shaved the administration's budget for some domestic agencies, such as the Department of Energy.

His budget-cutting reputation notwithstanding, Reagan made significant success almost impossible from the start of his administration by putting the major entitlement programs and the Pentagon essentially off-limits. Stockman now acknowledges that "our biggest failure was that we didn't create a much bigger and better package of spending cuts in the beginning. We should have gone after the big boulders—the social insurance programs. The rest of the budget is thousands of little pebbles."

It certainly didn't help matters that some of the administration's proposals involved phantom reductions. Stockman, for example, has confessed that "there was less there than met the eye" with the original spending cuts because the budget being reduced was artificially high. Two early "cuts" were downright fraudulent: spending for the Strategic Petroleum Reserve, which is now running about $2 billion annually, was simply placed off-budget, and Medicare payments were shifted back and forth between fiscal years 1981 and 1982.

This sort of budgeting with mirrors reappeared the following year, when Reagan pushed a tax hike through Congress on the strength of a promised three-year spending cut of some $284 billion. More than half that "savings" was simply a readjustment in arbitrary estimates of such things as interest rates. Some of the remaining reductions were equally dubious.

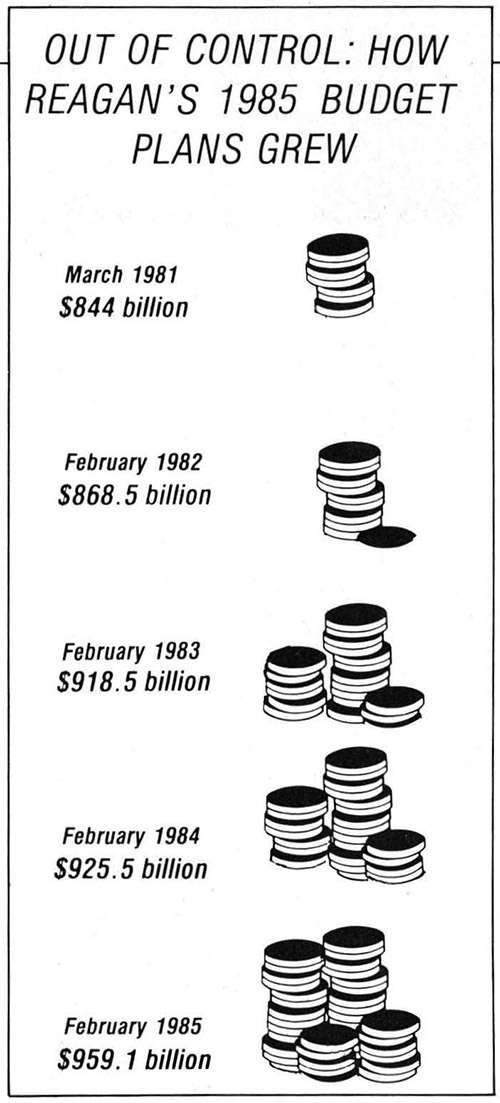

Moreover, Reagan did not propose all of the cuts he promised. The first-year budget program, for example, contained what Stockman called the "magic asterisk"—budget cuts to be identified in the future. But many never were. Partly as a result, Reagan's budget projections got progressively worse. His proposed budget for 1985, for example, has constantly escalated, going in nominal dollars from $844 billion in March 1981 to $959 billion in February 1985 (see chart on p. 43).

Reagan's cabinet officers and other agency heads are also among those responsible for the failure to curb spending. Many have consistently requested more than the official ceilings projected the previous year, let alone the levels first proposed in 1981. At the same time, the size of the cuts they have proposed to Congress has steadily fallen. The administration does not formally release internal agency requests, but some officials leak their department positions to build pressure from bureaucratic constituents and Congress. In December 1983, for example, the newsletter Inside Energy reported that "Energy Secretary Donald Hodel's credibility in budgetary matters appeared redeemed last week as DOE prevailed…to restore $800 million of the approximately $1.8 billion cut" from its 1985 budget by OMB.

This problem became so pronounced in the fall of 1983 that Reagan publicly ordered his cabinet members to revise their budgets to get them below the 1985 projections made the previous February. Presidential spokesman Larry Speakes called Reagan "stern and determined," but White House officials privately concede that virtually nothing came of the effort: the total budget request that went forward in 1984 was still higher than Reagan's 1983 estimates. Knowledgeable White House officials say that Reagan articulates the overall goal of cutting spending, but "item by item he caves in."

Even when Reagan restrains departments' budget requests, their officials often invite Congress to appropriate additional funds. In 1982, OMB was forced to instruct agency personnel to "refrain from giving opinions on how agencies might use more appropriations than the President requested," in order to help "strengthen discipline and support for the President's budget within the Executive Branch."

And despite Reagan's denunciations of Congress's free-spending ways, he has vetoed only five money bills. (One of those actually appropriated less than Reagan wanted by slashing his proposed outlays for the military.) Reagan has wielded the veto as a threat, setting veto benchmarks above his proposals—but those targets must be too high, since Reagan seldom feels a need to veto anything. White House chief of staff and former Treasury secretary Donald Regan says that "Congress keeps slipping in, just over the edge, just taking a little bit, so there's nothing mammoth" to veto. But if the administration doesn't veto those bills, Congress will keep "slipping in" added spending, and total federal outlays will just keep on rising.

Another reason that the budget hasn't been tamed is conscious policy decisions by the administration. Reagan reversed himself on cutting both the Social Security minimum benefit, which he had earlier pushed Congress to eliminate, and the Export-Import Bank, which he had denounced in 1981 as "another major business subsidy." In 1983 he joined with Congress to enact a $5-billion pork-laden "jobs" bill and to pass the $8-billion bailout of the International Monetary Fund (IMF). Moreover, the administration accepted roughly $1 billion in additional housing spending, some for a program that had been axed, to get the IMF legislation through the House.

Low Taxes! Big Spending!

Ultimately, Reagan is a politician before a budget-cutter. In 1983 he denounced Congress for its profligate ways—then moments later in the same speech told the National Association of Home Builders that he was proposing an additional $5 billion for federal mortgage insurance on top of the $6 billion that had been approved six months earlier.

Which brings us back to the current season of budget-cutting. With his usual eloquence, Reagan used his inaugural speech in January to attack the federal behemoth—despite the fact that he had been in charge for four years. His newest budget includes meaningful cuts, but even before submitting it, Reagan made substantial progress almost impossible. Last year, for example, he vowed not to cut Social Security benefits "for anybody," and he assured senior citizens that he would "not betray" them in an effort to cut spending. Yet Social Security and Medicare are two of the largest domestic programs.

So unless Reagan decides to do an about-face on defense (and so far, he has supported Defense Secretary Caspar Weinberger's intransigent demands for more money), the administration will continue to face a budget picture similar to that of 1981, with only a small portion of the budget open for cuts.

Indeed, the prospects are bleaker now than before. Since 1981, discretionary programs that can be cut without changing the law itself (unlike entitlement programs) have been reduced, many sharply; so Congress is unlikely to vote significant additional savings. Reagan once argued that cutting government spending "is like protecting your virtue: all you have to do is say no." But by the end of his second term, he probably will have made only modest adjustments in a few programs. Government, on the whole, will continue to grow.

In February 1981, Meg Greenfield wondered whether the administration's approach—"crashing through that layer of hypocrisy and that structure of legal payoffs that characterize our traditional budget building"—was "doomed." Despite Reagan's success in holding down spending in some areas, it appears that the answer to her question is yes.

As David Stockman observed three years after becoming the administration's resident wunderkind: "The budget system is not the problem. The problem is that this democracy is somewhat ambivalent about what it wants. It wants low taxes and substantial public spending." And until the public finally makes a choice, a genuine budget revolution—whether carried out by Reagan or someone else—seems unlikely.

Doug Bandow is a senior fellow at the Cato Institute and a nationally syndicated columnist.