Elon Musk and Other Billionaire Welfare Cases

And what taxpayers can do to stop it.

Tech billionaire Elon Musk is known for leading Tesla and SpaceX, as one of the visionaries behind PayPal, and for hyping bitcoin and a bold plan to colonize Mars.

He's not just one of the planet's richest people, he's one of its biggest recipients of government handouts, according to Lisa Conyers and Phil Harvey, authors of Welfare for the Rich: How Your Tax Dollars End Up in Millionaires' Pockets—And What You Can do About It. Conyers is a veteran journalist and co-author with Harvey of 2016's The Human Cost of Welfare. Harvey is a successful businessman and philanthropist who supports many libertarian organizations, including Reason Foundation, the nonprofit that publishes this website.

By 2015, companies led by Musk had already gotten billions in subsidies, tax breaks, and other handouts. He's not alone. There are thousands of other immensely rich people who are constantly milking the government for special perks, carveouts, and handouts.

Here are five of the very worst ways they do that.

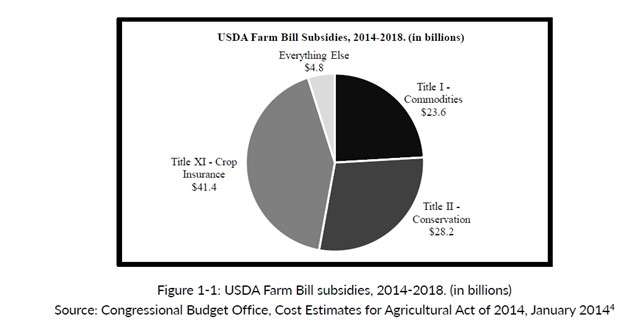

Since 1933, when Congress passed the first farm support bill, the government has been shoveling billions of dollars in the form of crop insurance, cash payouts, and other subsidies to the smaller and smaller number of American farmers. As Conyers and Harvey document, former Obama commerce secretary and billionaire Penny Pritzker received $1.6 million in subsidies between 1996 and 2006, and current Republican South Dakota Gov. Kristi Noem was part of a family business that got over $3 million in subsidies between 1995 and 2008.

2. Sugar Subsidies

Because of protectionist tariffs and price supports, Americans pay around triple the world price for sugar, thanks to efforts by billionaires like Fanjul brothers, Alfy and Pepe, dubbed "the first family of corporate welfare" by Time magazine.

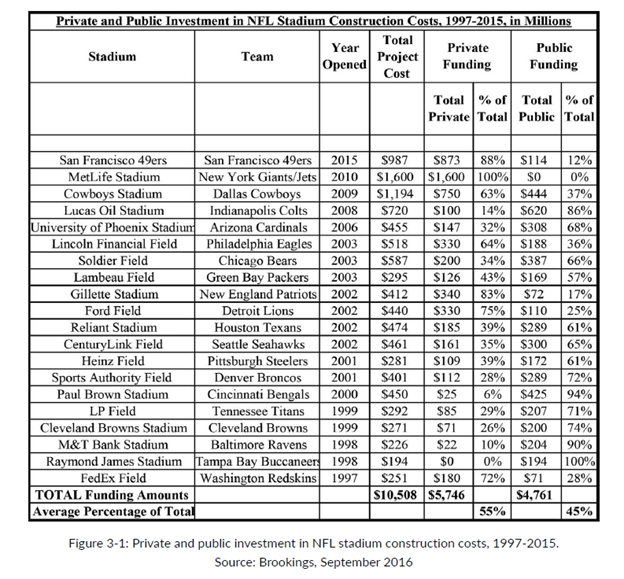

Many, if not most, major pro sports team owners are billionaires.

Yet between 1997 and 2015, almost half of all construction costs for new NFL stadiums were covered by taxpayers. In the case of Raymond James Stadium, home to Super Bowl champs the Tampa Bay Buccaneers, taxpayers ponied up 100 percent of building costs. Plus, the team basically gets all revenue generated at the stadium too.

4. Mickey Mouse Subsidies

The Walt Disney Corporation, with a market cap of $368 billion, is the heavyweight champ among theme park operators when it comes to sweetheart deals. Disney "returned $2.3 billion to investors in 2017 alone" write Conyers and Harvey, and Bob Iger, chairman and CEO, "earns $45 million a year." So of course Disneyland, located in Anaheim, California, needs handouts.

Twenty-five years ago, Anaheim built Disney a new parking structure that cost $108 million and then leased it to the company for the high price of $1 a year. In 2015, the city agreed to exempt the park from paying entertainment taxes for 45 years, and in 2016, it agreed to a $650 million tax rebate on a luxury hotel Disney built near "the happiest place on Earth."

5. Energy Freebies

Over the past decade, Peabody, the largest private coal company in the world, pulled in around $275 million in state and federal subsidies while generating $5.6 billion in revenue in 2017. Exelon, a power company that specializes in nuclear energy, generated $34 billion in revenue in 2017, the year after it gulled New York state into giving it $7.6 billion to keep four aging and underperforming nuclear power plants going.

A few years back, New York state also shelled out $750 million to build a factory for Elon Musk's renewable energy company Solar City. Elected officials then decreed the company would pay no property taxes for a decade, saving the billionaire another $260 million.

But as Conyers and Harvey argue, in our information-rich world, citizen activists are fighting back. In Louisiana, when one group learned that Exxon and other gas and oil companies were getting away without paying property taxes, it led to a new public accountability law.

They also point to websites that track subsidies and handouts, empowering citizens to protest the use of tax dollars to gild the pockets of mega-corporations and the billionaires who own them.

If and when Elon Musk actually makes it to Mars, let's make sure he buys his own ticket.

Narrated by Nick Gillespie. Edited by John Osterhoudt. Additional graphics by Paul Detrick and Meredith Bragg. Color correction by Regan Taylor.

Photo: Steve Jurvetson/Flickr/Creative Commons; Daniel Oberhaus/Flickr/Creative Commons; JD Lasica/Flickr/Creative Commons; Maurizio Pesce/Flickr/Creative Commons; Airman Magazine/Flickr/Creative Commons; Commerce Department/ZUMA Press/Newscom; JOE MARINO/UPI/Newscom; Taylor Jones/ZUMA Press/Newscom; Taylor Jones/ZUMA Press/Newscom; K.C. Alfred/ZUMA Press/Newscom; Bill Bachmann/DanitaDelimont.com "Danita Delimont Photography"/Airman 1st Class Jacob Wrightsma/2nd Bomb Wing Public Affairs/Newscom; Stephen M. Dowell/TNS/Newscom; Douglas R. Clifford/ZUMA Press/Newscom; Xavier Collin/Image Press Agency/MEGA; Mark Eades/ZUMA Press/Newscom; Clem Murray/TNS/Newscom; Heather Charles/MCT/Newscom; RASHID ABBASI/REUTERS/Newscom; LEE CELANO/REUTERS/Newscom; LEE CELANO/REUTERS/Newscom