Capital Flight

The hidden power of technology to shrink big government

These words are being typed in a plane at 33,000 feet en route to St. Louis. The computer I am using is about the size and weight of a small box of Tide, but it has the internal memory of the University of Maryland's entire computer center when I was a graduate student there two decades ago. I carry in my shirt pocket enough disks to conduct the business of a modest-sized firm.

The small size but great power of modern computers is no longer astounding. What is not fully recognized, however, is that the computing power on my lap represents an immense threat to the economic and political power of the U.S. government and other governments around the world. Because technology is changing the nature of capitalism, my computer represents a liberation of "people power." Capital is being freed from the strict confines of arbitrary national boundaries; it is becoming internationalized to an extent never before imagined. As a consequence, the power of government to tax and regulate may be in its twilight years.

I am sure no one worries that I, or anyone else with a laptop computer, will plot and orchestrate the overthrow of any government. On the contrary, the machine represents a threat to governments precisely because it, along with many other technological wonders, makes governments marginally less valuable, even as an object of overthrow. By making the capital in capitalism far more elusive and far more difficult for governments to control, technology is gradually eroding their monopoly power and could ultimately reduce people's incentive to control governments (or the people who run them).

With similar or even more powerful laptop computers, portable telephones, and fax machines, modern entrepreneurs have the country, and world, at their command. With modems, they can send production orders throughout the globe. More important, they can pit producers around the world one against another in a competitive struggle, calling up on their computer screens alternative bids for jobs that often can be done with equal ease in St. Louis, Missouri; Camden, South Carolina; or Trincomalee, Sri Lanka.

The political impact of today's technological advancements differs markedly from those of past decades. One or two hundred years ago, industry enjoyed technologies that spawned economies of scale—progressively higher production levels with larger and often more geographically concentrated plants and equipment. The symbol of economic progress became the assembly line, winding like a maze through plants that covered hundreds of acres. Managers were then, as some remain today, painfully aware that their vast amounts of capital were more or less fixed in place by prohibitively high relocation costs.

In the unmovable plants, and the people tied to them by employment, governments had a source of power. Like an oil field, it could be tapped, in this case with a variety of tax and regulatory drills. The powers of government to regulate and tax were largely unchecked, except by the rules of everyday politics. When capital could not move except at great expense, legislators did not need to worry very much about "capital flight" or "runaway plants"—terms that did not become popular until the industrial-policy debates of the last decade. Firms could then only grin and bear it, or pay the political-influence piper.

Government power over capital and people has hardly faded away. Some capital is still difficult to move or is altogether immobile. Government, measured in expenditures in real-dollar terms, has continued to grow in the United States in spite of professed efforts by a conservative Republican president to slash its size.

Nevertheless, government growth is waning. Rhetoric is changing. The economic powers of governments are dissipating, at least "around the edges." The trend is evident in the spreading conviction that government cannot be the solution to all social ills. And it is evident in legislators' push toward protectionism—which can serve to restore the fading ability of government to contain and control the stream of tax revenues from the nation's business and people tax base.

The concern of legislators is well-founded. In important respects, capital is going through a metamorphosis.

Technology is having this effect partly by "miniaturizing" capital. The computer power that once filled a room now sits neatly on my lap. The work of three or four old fly-shuttle looms, each the size of a small car, can now be done by a single jet-air loom that takes up one-third the floor space and greatly increases the quality of the fabric produced. Firm records that once were crowded into file drawers now can be etched on chips or the back of credit cards. Plants that once rose several stories, spanned hundreds of acres, and employed thousands fit today in one story on a one-acre concrete slab and employ fewer than 100. While Fortune 500 firms lost 2.8 million jobs between 1980 and 1986, 10 million were added in the economy. Virtually all the employment growth on a net basis occurred in companies with fewer than 100 employees, not the industrial giants.

Everywhere, the economy is down-sizing as firms reduce the size and scope of operating units. In a 1988 Business Month survey of CEOs, 39 percent indicated that they had down-sized their companies over the previous two years and half of them expected to continue the process.

In no uncertain terms, the trend is now toward "de-economies of scale," getting a much more productive bang in smaller-size plants and equipment. The trend is so pronounced that a Texas computer manufacturer boasts of its tailor-made computers with the slogan, "Mass production in runs of one."

In becoming smaller, less visible, and less tangible, capital has also become vastly more mobile. When the dollar fell in value relative to the yen, for example, Ricoh quickly shifted photocopier production to the United States; Sony ships products to Europe from plants in Alabama and Florida; and Honda is even planning to ship made-in-Ohio cars back to Japan.

The nature of capital is changing drastically in other ways, too. With machinery giving way to circuit boards and production becoming far more sophisticated and complex, specialization of capital and labor has escalated. Human capital has become a relatively more important source of economic power: in 1950, 6 percent of the U.S. population had completed four or more years of college; by 1986, the percentage had more than tripled, to over 19 percent. Of course, skilled workers possess a good deal of human capital, as well, and all workers have some human capital.

One of the most interesting and unrecognized political distinctions between human and physical capital is that the human version can pick up and walk out on its own, whereas physical capital cannot always move so readily. In addition, the spread of human capital through education means that capital under democratic capitalism has been given more votes and therefore more protection from abuse by majoritarian politics.

Information, now no more physical than the electronic blips on a computer disk or tape, has become a decisive capital asset. But information remains fluid, easily converted to electromagnetic fields, difficult to contain in any one place, and ready to leap whole continents via satellites.

As information becomes more critical, companies are changing internally. The firm has always been useful because it enables people to work together with relative ease. When communicating at a distance was difficult or costly, people had to be in close proximity—even in the same building and on the same floor. Personal contact was then the cheapest way to maintain the constant and necessary interchange of information and to ensure cooperative efforts between the managers and the managed. A hierarchical structure suited these needs.

"Togetherness" is not about to disappear from the workplace. However, modern technology that reduces communication and transaction costs also enables firms to rely, at least marginally, less on internal command structures and more on external market transactions. Firms can break up geographically and spread their production units across government jurisdictions in this country and abroad. The new information technology permits the emergence of the "hollow corporation"—a highly mobile firm that itself owns little capital but "produces" goods by relying on outside suppliers.

With the stroke of a few keys in an office, on a boat, or at a mountaintop retreat—and for the cost of a telephone call—modern managers can, via satellite, send hundreds of pages of crucial firm-specific information on design or costs or schedules to virtually any point on the globe at almost the speed of light. They can shift the world's physical capital stock, or the use of it, across national boundaries at the speed of light.

Modern managers can thus escape the reckless authority of governments to regulate and control. The emerging technology enables managers to say, if so inclined, in so many words and deeds, "I'm mad as hell and I don't have to take it anymore."

All these changes are forcing legislators to think carefully about economic, and not just political, constraints on their governing. Legislated policies can influence people's willingness to work, save, and invest within the confines of the politicians' governmental jurisdiction. So political aspirations, seemingly played out solely under the rules of ordinary politics and untainted by economic constraints, are increasingly subject to the electorate's propensity to move elsewhere or "vote with their feet"—or, more to the point, to remove not just their bodies and their votes but their income and their capital.

People have some demand for earning their livelihood and holding their capital in any given government jurisdiction—Maryland compared to Utah, or the United States rather than Taiwan. How much income they want to earn and capital stock they want to hold in a jurisdiction depends on a host of factors, not the least of which is the "tax-price" on income and capital and the implicit cost of regulations, interest rates, inflation, and so on imposed or caused by governments.

People's responsiveness to changes in taxes and in the cost of control depends partly on how easy it is for them to move themselves or relocate their capital. Governments must now understand an important economic principle: the greater the ease of relocation, the more responsive will be people's demand for living and working within a jurisdiction.

In the not-too-distant past, when people and capital faced substantial technological and economic barriers to relocation, legislators could reasonably assume that raising taxes in their jurisdictions would generate more revenues. Legislators could concern themselves mainly with assessing the need for additional revenue and determining whether the coalition of voters that supported them would be sufficiently upset by a tax increase to turn them out of office.

Today, however, legislators face a growing economic constraint. Escalating technological changes that boost the mobility of people and capital have increased the responsiveness to changes wrought by government. Now, legislators have to worry that a tax increase will drive people and capital away, cutting into tax revenues (especially in the long run).

People, who hold a great deal of capital on their persons, can move more readily at lower cost. And the knowledge (capital) that people have is difficult to confiscate before movement. With telephones, fax machines, and computers, people and their plants are not as bound by geography in the conduct of business as they once were. They can more easily pack up and ship out their capital, the critical components of which may be on disks or chips that can be manipulated with a computer no bigger than the one on my lap. Production orders can be readily switched with the stroke of a few keys to suppliers in other government jurisdictions that offer capital more favorable treatment.

To be effective in tempering the power of governments, the accelerating mobility of capital need not actually result in more movement. Legislators around the world need only recognize the threat of mobility. They need only realize that they must help businesses be competitive by making their own policies competitive. The political result should be less enthusiasm from politicians for more and more government funded by higher taxes.

We are today seeing the types of policy movements expected in a world of growing human and physical capital mobility. Policies that are under way or being debated include:

• Incorporating "supply-side incentives," such as lower marginal tax rates on individual and capital income.

• Making government bureaucracies and regulations meet cost-effectiveness and efficiency tests (including workplace-health or environmental regulations).

• Curtailing industry regulation—of airlines, trucking, banking—that restricts the adaptability of capital to market needs.

• Privatizing various government functions, from passenger train service to street sweeping.

• Devolving federal services to state and local governments, where the level and quality of service can be determined by competition among governments.

In general, among policymakers who see a need to make America "competitive" again, a growing number grasp the potential of releasing constraints on capital and income.

Of course, the general policy trend in the United States is partly attributable to the intellectual heritage or political dogma of particular public personalities, not the least of whom are Ronald Reagan and his early economic advisors. It is also partly grounded in decades of experience with flawed, overly aggressive government attempts to solve every social ill.

Yet concern for the country's competitiveness appears to be too broadly grounded in all segments of the political spectrum to believe that politicians and policymakers do not sense that their very own livelihoods and power bases, achieved through government, can be secured by making governments more competitive. Constant talk of the "globalization of markets" and the "integration of the world economy" speaks to governments' loss of control and monopolistic power over what is produced where. To succeed, policymakers must adjust their authoritarian inclinations—downward.

More than two centuries ago, the Founding Fathers understood the restraining influence of competition among governments. James Madison, for example, saw the two houses of Congress as a device for restricting the policymaking process, not for facilitating it. Likewise, ensuring the states' political independence would unleash the forces of competition, limiting states' power to tax and therefore to expand.

Granted, governments have grown in spite of the protections that Madison and the other Founders tried to incorporate in the Constitution. Succeeding governments had the luxury of increases in demand for government services and the growing economies of production scale that effectively immobilized capital and people. That, however, is no longer the trend.

The message buried in modern technological developments is that the world is in effect becoming federalized, relentlessly, in a rough and ready way. Because countries are now forced, or will soon be forced, to compete with one another, they must search for ways to retain and expand their tax bases. Already, modern capital can jump national boundaries with far greater ease than capital could jump state boundaries when Madison wrote his Federalist essays in the 1780s.

Support for the central thesis of this commentary can be found not only in the rhetoric of government policymakers around the world—including Mikhail Gorbachev talking up a restructuring of the Soviet economy. Preliminary evidence can also be found in the declining rate of growth of governments.

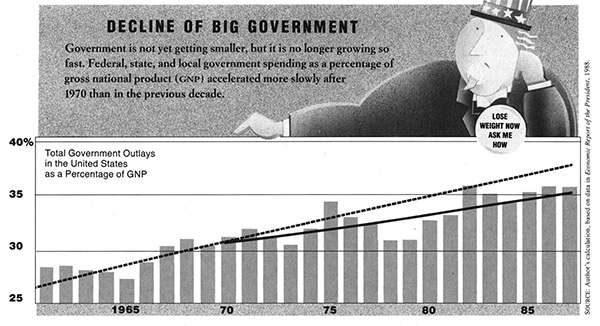

Consider the figure on page 24, which charts the combined growth of all governments (federal, state, and local) in the United States. The bars record total government outlays as a percentage of U.S. gross national product (which may be construed as the average tax rate). The dotted line plots the 1960–70 trend in the ratio of government outlays to GNP and projects it into the future. The shorter line plots the trend in the ratio from 1970 to 1987.

Obviously, government expenditures as a percentage of GNP grew throughout most of the period, but it is equally obvious from the lower trend line that the growth of government relative to national production began to slow in the 1970s. Indeed, in the 1970–87 period, the average annual rate of growth (0.8 percent) was cut to virtually half the rate of growth in the 1960–70 period (1.5 percent). (When the time periods for the two trend lines are changed to 1960–75 and 1975–87, much the same pattern is revealed.)

Government in the United States is not, or not yet, getting smaller in absolute terms. Furthermore, the slower pace of growth may be consistent with alternative hypotheses (for example, the controlling majority in Congress has shifted, resulting in more-conservative governments, or government has shifted its burden from expenditures to regulations). Nonetheless, these numbers offer at least preliminary evidence, and some hope, that competitive pressures on governments are building and may in fact cause a continuing relative, if not absolute, decline in government at some point in the future.

The rest of the industrialized world shows a similar pattern. Government outlays as a percentage of gross domestic product (GDP) in Japan peaked in 1984 at 34 percent and fell slightly in 1985 (the last year for which data are available). Outlays in Canada as a percentage of GDP were virtually flat, at 46 to 47 percent, between 1982 and 1984. In the United Kingdom, the trend was also flat or slightly downward in the early 1980s, going from 48.7 percent in 1981 to 47.7 percent in 1985. The trend in West Germany has been flat since the middle of the '70s, moving between 48 and 50 percent. Australia and almost all smaller European countries follow much the same path. Of the major industrialized countries, only France and Italy have not tempered the growth in outlays as a percentage of GDP.

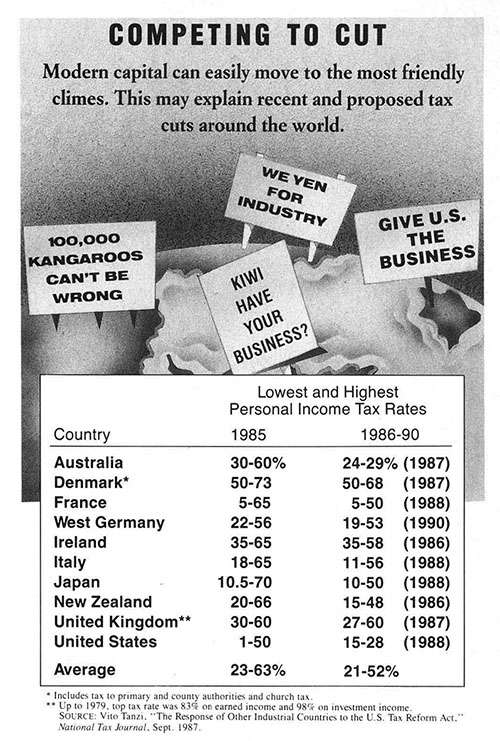

Direct evidence that countries are being forced to compete with one another can be found in the response of major governments around the world when the United States lowered its marginal tax rates (see table above). Except for the United Kingdom, all the industrialized countries significantly reduced tax rates starting in 1986. (And the United Kingdom had already lowered its highest marginal tax rates on earned income from 83 to 60 percent between 1979 and 1985.) Overall, countries reduced their highest tax rates by over 11 percent, from an average of 63 percent to 52 percent. And most of the countries either have reduced or plan to reduce tax rates on corporate income, as well.

In recent years, tax competition has been extended to many newly developing and less-developed countries, also. Economist Alan Reynolds reports significant marginal tax-rate reductions in Singapore, South Korea, the Philippines, Indonesia, Turkey, Jamaica, Colombia, Bolivia, Mexico, Grenada, Botswana, Ciskei, Mauritius, India, Israel, and China. Why did these countries lower tax rates? Reynolds wrote:

"Countries, like companies, must compete in producing the most value at the lowest possible cost. Taxes are an important part of the cost of production, as well as the cost of living.…It is relatively insignificant whether taxes are direct or indirect, corporate or personal. Capital and labor bear all taxes, either through lower incomes or higher prices.…Any country in which the marginal cost of government is not competitive will experience a loss of both real capital (a capital outflow) and human capital (a 'brain drain')."

Admittedly, the analysis here is replete with optimism. Perhaps it is too optimistic. After all, the flattening of the growth in government outlays relative to national production may be a temporary phenomenon, attributable more to a rapid expansion of production on a worldwide basis than to discretionary fiscal restraint on the part of governments. Economic nirvana is hardly just around the corner of technological development.

Yet theory and evidence appear to be reinforcing one another. Fundamental economic forces that transcend national boundaries may actually be in the process of checking, albeit marginally, the enormous power of government to tax and regulate. Governments may very well become weaker, at least relatively and marginally, and for good reason. Politics will likely become less important, albeit slightly, in shaping people's affairs. The political process will be constrained by the growing mobility of people, capital, and goods and services.

These economic forces suggest that in the future, fewer resources may be used in private efforts to manipulate government policies; more resources will then be available for producing the goods and services people around the world need and want. More and more, politicians' ambitions will be checked not by ideology (or the lack thereof) but by the threat of shifting income bases.

World governments cannot be expected to "lie down and play dead" in the face of growing competition among governments. Bashing of Japan, Taiwan, Korea, and many other countries will continue to be the natural rhetorical game in Washington, for example. Politicians can be expected to seek ways of disguising the cost of new and expanded programs (mandated benefits, minimum-wage hikes, etc.). They can also be expected to seek methods of "international cooperation" in policy formulation—that is, to form cartels, much like OPEC, in an attempt to jointly contain the growing mobility of capital across national boundaries.

In doing so, however, governments will likely be swimming against the more powerful undercurrent of technological development. Governments may mitigate, but they will not be able to totally negate, their net loss of the political power to tax and control. And therein lies a technology-driven liberation: individuals will be more able to do what they want to do.

Richard B. McKenzie is a professor of economics at Clemson University and the author of The American Job Machine. This article is adapted from a policy analysis prepared for the Cato Institute.