A New Way to Forecast the Inflation Cycle

Forget about those new money-supply figures. You have to look at domestic credit expansion if you want to understand the monetary future.

Inflation is a form of national bankruptcy. It is not only a symptom of deep political and economic malaise in society but causes its own disastrous consequences for society that are well known. What is so striking about our contemporary inflation is how politicians, bureaucrats, and the public have become resigned to it, as though it is a disease beyond anyone's control. The typical line one hears from government, which ultimately must take responsibility for inflation, is that "we too are victims of inflation."

While one can argue about the ultimate causes of inflation—whether it be lack of a gold standard or fixed exchange rates, budget deficits, the expanding welfare state, declining productivity, environmental restrictions and government controls, etc.—one thing is certain: inflation cannot exist and flourish without central bank cooperation, accommodation, and even encouragement. Inflation must be financed. If central banks are going to finance it, they should do it in the open so that everyone knows what the rules of the game are. One of the great problems with inflation is that central banks and governments say they are not going to permit inflation, that they are going to pursue anti-inflationary monetary policies, and yet they do precisely the opposite. My purpose here is to explain why this has been the case in the United States. The story is the same in Britain and Canada, where inflation has been a similar problem.

In addition to looking at how inflation is financed, I will show how it can be measured in a way that gives a clear guide to policymakers if they really want to stop inflation. The analysis gives a clear guide to investors and people in business, as well, because it indicates when and how government policy and interest rates must eventually respond to accelerating inflationary pressure. The analysis is useful in explaining what has happened in the past and provides a useful technique for forecasting, an example of which is included with some conclusions based on data available at the end of February 1980. The reader, who will be seeing this well after it was written, should keep in mind the speculative nature of the forecasts, since at the time of writing events were moving dramatically, and in an election year some equally dramatic political response was to be expected.

MONETARISM RUN AMOK

The progressive shift away from the simplistic demand-management and fine-tuning policies of the 1950s and '60s to so-called practical monetarism, beginning with Arthur Burns at the Federal Reserve in 1970, was supposed to be a watershed in official economic policy. The belated discovery of "money" at the Fed 10 years ago and the supposed containment of money supply growth with predetermined target ranges set by the Fed held out great hope that the economy could be returned to a noninflationary stable growth path.

In remarkable contrast to the hope generated by this policy shift, however, we have experienced two runaway inflations. The first, which reached its full flowering in 1973-74, saw the increase in wholesale prices hit a peak of 32 percent. The current accelerating inflation was still raging out of control at the end of February, with the rate of increase of wholesale prices hitting almost 20 percent.

The obvious question is, What went so badly wrong with "practical monetarism"? Assuming that intelligent, well-meaning people run the Fed, why has the actual performance of the economy and inflation been so disastrous? The reason is that the monetary authorities do not know what they are doing. By focusing on a relatively narrow measure of money, such as M2—or, even worse, M1—they are missing the actual financing of excessive credit demands. They have, in effect, permitted or acquiesced in a massive credit inflation. Even apart from definitional and measurement problems with what money is, they have focused unduly on the supply of and demand for money, removing themselves from the far more significant process of credit creation and how money comes into existence.

Money comes into existence in a roundabout way because people, firms, governments, and so on demand credit to finance expenditures. When these demands are excessive relative to the supply of domestic savings and the central bank is attempting to hold interest rates down, the result is excess demand, where demand runs way ahead of the domestic economy's ability to supply. A broad measure of money provides one useful barometer of such potentially inflationary pressures. There are circumstances, however, when even such a measure can prove extremely misleading. A more accurate and comprehensive guide is, in fact, provided by the underlying excess credit creation that finances these excess demands and provides the motive force behind the inflationary process.

In assessing whether inflationary credit demands exist in an economy, it is essential to utilize a framework that takes into account broader monetary and credit aggregates rather than conventionally published Federal Reserve money data. Only then can one get an accurate barometric reading of the magnitude of money and credit excesses. So long as the authorities choose to focus on a defective inflationary barometer for guidance, they will stumble from one crisis to the next, leaving intact the long-term secular rise in inflation and interest rates.

CREDIT PRESSURE

Domestic credit expansion (DCE) is an elusive concept. Just as money supply has a habit of changing form at the very moment when everyone thinks he knows what it is, so DCE can be defined in a number of different ways. To make sense of any of the myriad financial statistics spewed out by the official reporting agencies, it is crucially important to have some conceptual framework within which such information plays a vital role. And the objective here is to provide a framework for interpreting the data available, not necessarily—nor, as it turns out, usually—the information spoon-fed by the authorities to their waiting and expectant public. Development and use of DCE in the United States (See "DCE: An Indicator of Excess Money Creation," Bank Credit Analyst, May 1978, p. 29) is a piece of the complex and half-completed jigsaw that can be used to provide insights into the evolution of market behavior.

Low growth of the money supply (even when broadly defined) does not necessarily mean that excess demand is also low—it would be nice if that were so. It could be that instead of excessive demand (financed through the creation of new credit from the banking system) showing up in higher prices, the money is spent on imported goods and services and consequently flows abroad. As with rising prices, the deterioration on external account must sooner or later lead to tighter monetary policy and higher interest rates. Moreover, the effect will still be inflationary, but the lags will take longer to work out—exactly the process we are seeing in the United States at present.

Attempts to improve the balance of payments directly, or depreciation of the exchange rate (nature's own cure), will turn the excess demand into inflation of the domestic price level. But the cause is still the original creation of excess demand. It is essential not to lose sight of this in all the confusion as the traditional whipping boys are dragged out for their customary ritualistic flogging. For example, President Carter continues to blame the current high rates of US inflation on OPEC for raising the price of oil and on Congress for not passing his energy bill. Yet Switzerland and Germany pay OPEC prices for all of their oil and do not have legislative problems with energy bills, yet they have far lower inflation rates than the United States does.

DCE is an attempt to identify this underlying excess demand, financed originally through excessive credit expansion. In this sense it is like the supply of money but abstracts from the leakages abroad. But it also has an added advantage, which takes on growing importance at this time of continuing financial innovation: it takes into account the potential credit-creating ability of the banks that is financed through sources other than those included in definitions of deposits subject to Fed control. The difference in the growth rates of DCE and the money supply are truly dramatic, as discussed below.

The measure of DCE employed here is, in fact, different from that found in official statistics, such as those of the International Monetary Fund and Bank of England. That need not cause any concern. Like the money supply, DCE can come in many different shapes and sizes. The measure explained here has been constructed to reflect the borrowing needs of the total nonbank domestic economy—government at all levels and the private sector—that have not been financed by loans from fellow citizens.

In the economy as a whole, the public and private sectors combined have a borrowing requirement that must be financed. It can be financed in three ways: from the nonbank domestic sector, from foreigners, and from the domestic banks. When borrowing requirements are excessive relative to domestic savings, additional credit can be created through the banking system or from abroad. This new credit is available to finance additional expenditures and is potentially inflationary; how inflationary depends on the current stage of the business cycle. The DCE series is employed in an attempt to identify the underlying demand pressure in the economy before all the camouflage of currency outflows and deposit distortions has been added.

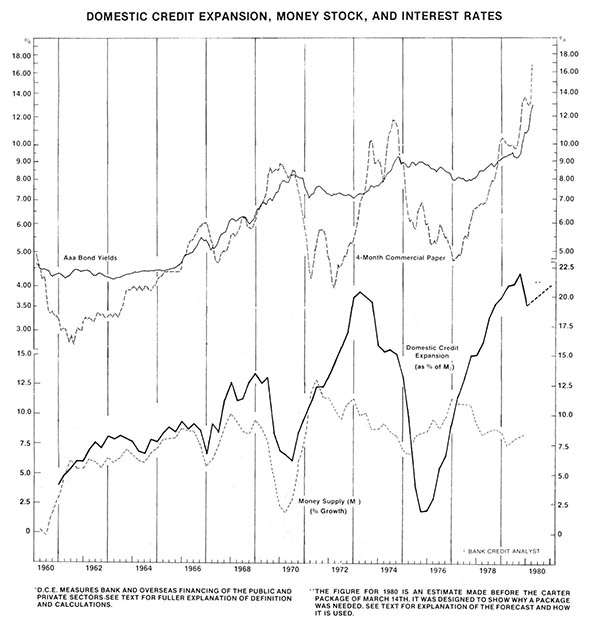

The chart below plots quarterly DCE figures for the United States since 1960. It is shown as a four-quarter moving total expressed as a percentage change on the money stock (M2) of the previous year. Also shown is the rate of growth of M2. Each of the four cycles can clearly be seen. There is a progressive acceleration of growth in DCE above M2 growth during the expansionary phase of each cycle when interest rates are rising, followed by a contractionary phase when DCE falls relative to M2.

Three points emerge from the analysis of DCE relative to M2:

1. Each cyclical rise of DCE is larger relative to M2 than the previous cycle. In particular, during two cycles since 1970 following the Fed's move to a monetarist policy of supposedly controlling money supply, the amplitude of the cyclical swings has become far greater.

2. From the point of view of monetary control, it is extremely misleading to focus on M2. During the last three cycles, M2 decelerated well before the end of the expansionary phase of the cycle, while DCE was still accelerating. Focus on M2 creates a tendency for the authorities to relax policy too early, allowing inflationary momentum and speculation to gather enormous momentum at the end of the boom and thus forcing the central bank into overkill. This helps to explain why each cycle has become more extreme and more dangerous.

It should also be noted that the narrower definition of money—M1 and its current variants, M1A and M1B—are far smaller relative to DCE than is M2. Moreover, with a structurally high level of interest rates, the opportunity cost of holding liquidity in non-interest-bearing form becomes enormous. Hence, concentrating attention on M1 can be even more seriously misleading than using M2. An excellent example of this occurred in late 1978 and early 1979. M1 decelerated sharply, creating widespread fears of recession on the part of the naive monetarist school. The Fed authorities eased up and created a huge extension to their inflationary monster. They made the same mistake in late 1973 and early 1974 and also in late 1968.

3. From a timing point of view, it is evident that DCE leads the interest rate cycle. At the trough of the cycle, DCE growth is faster than M growth. But it takes some time before interest rates turn up. At the top of the cycle, DCE growth peaks out well before the peak in rates. In fact, around the last three cyclical peaks—1966-67, 1969-70, and 1974—short rates did not peak out until DCE had fallen sharply and for four quarters. Since DCE in the current cycle made a new high in the third quarter of 1979 and fell only moderately in the fourth quarter, with the likelihood of another rise in the first quarter of 1980, it would seem that interest rates might be some way from a peak in the absence of a change in either monetary or fiscal policy.

DCE IN YOUR FUTURE

DCE makes the past understandable, explaining where the economy has been and why certain things have happened. For example, it explains very well the magnitude of the rise in US interest rates in 1973-74 and from 1976 to the present. It also explains the chronic weakness of the US dollar, particularly during expansionary periods of the cycle.

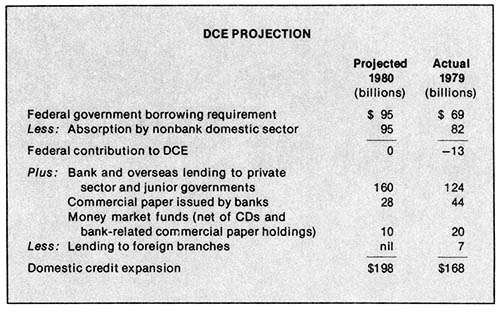

To get some idea of what could happen in the period ahead, it is necessary to attempt some forward estimates of DCE (see table). This is done by estimating the federal government's borrowing requirement and the proportion of it that will be absorbed by the nonbank domestic sector. The overall federal borrowing requirement figure is the sum of the government's own required borrowing needs plus agency borrowing and mortgage pool securities guaranteed by government agencies, all exclusive of acquisitions by government agencies and the Federal Reserve. This gives the federal government contribution to DCE. Added to that is estimated bank and overseas lending to other levels of government and to the private sector. Because the bank-related commercial paper market and money market funds have become so important as quasi-banking institutions, they are included as well. Subtracted from the total is bank lending to foreign branches, as this does not add to domestic credit creation.

Estimates for the major components are made as an example of how the forecaster can use DCE in order to assess trends in US inflation, interest rates, and the dollar and thus be in a position to assess how and when government policy might be forced to change. These estimates are necessarily tentative and dependent on actual and anticipated government policy at this time. As policy changes, so these forecasts should be updated. Moreover, in the light of these projections we would very much hope that policy would be changed.

The estimated total government borrowing requirement is $95 billion. The projections include the very conservative assumption, as a result of the high level of nominal interest rates, that this can be absorbed completely by the nonbank sector. Thus the federal government's direct contribution to DCE could be close to zero. This is not by any means intended to suggest, however, that the government's borrowing requirement is irrelevant. On the contrary, a figure of about $100 billion, or 6½ percent of GNP, is hardly appropriate in a year of runaway inflation, overheated economic activity and labor markets, and interest rates at the highest level in US history. In effect, the federal government, by requiring so much financing, is and will be preempting credit flows to the private sector. As a result, the private sector is forced to finance heavily at the banks and from foreigners. To the extent the private sector is forced, permitted, or encouraged to finance at the banks, money supply rises. Since the government borrowing requirement is projected to be very high in 1980, bank and overseas lending is estimated to grow at a 15 percent rate, down somewhat from 1979, with commercial paper issued by banks and money market funds to contribute another $38 billion. As a result, DCE is projected, on unchanged policies, to grow by almost $200 billion in 1980 compared with $168 billion in 1979. As a percentage of M2, DCE growth would amount to almost 21 percent.

DCE is, as discussed above, a monetary concept, but it is much broader in scope than the simple monetarist notion of trying to control a monetary aggregate that is a rather narrow part of the economy. It includes the effect of the balance of payments on the financial system and money growth. It focuses on the creation of credit, which is the starting point for countries heading into serious financial disorder; and it gives an early-warning signal of when and how policy should change. Governments that ignore excessive DCE do so at great risk. The US government throughout the 1970-75 cycle and again throughout this cycle ignored the warning signs of excessive credit creation, current account deficits, chronic dollar weakness, devaluations, and a huge build-up of dollars in foreign official institutions. As a result, it encouraged massive speculation in inflation hedges and accelerating price inflation, which by early 1980 was into the runaway range of 17-19 percent.

While the DCE projection of almost $200 billion, or a 21 percent increase compared with the money stock, represents some leveling off, it is still wildly excessive and suggests a continuing accommodation to very high rates of inflation. In this environment, with intense military and geopolitical tensions in the world and a major rearmament program under way, stability is not likely to be restored. In fact, instability could be further heightened and the continuing crisis deepened.

GOVERNMENT OPTIONS

Having created such a massive and frightening speculative bubble, runaway inflation, and a bond market collapse, the government's options are relatively few. By focusing on DCE, one can narrow down the basic options in order to get some idea of what the government will do.

1. Nothing. This has been the "game plan" of the past three years. Essentially, it has been a bet that the boom would blow itself out at a relatively modest rate of price inflation. It has not worked because the Fed has continued to accommodate the boom with accelerating DCE and persistent efforts to protect the housing industry from rising interest rates. It could be that the game plan will be brought onside by a recession already triggered, but it remains a dangerous gamble.

2. Reduce the federal government borrowing requirement by:

• Cutting government expenditures. In practice, this is a hopeless task in the short run for almost any government. For a populist US government in an election year it can safely be ignored.

• Raising taxes. For the same reason as above, this can also be ignored.

• Reducing federal assistance to housing. Since housing is as sacred politically as motherhood, and because the industry is already in an advanced state of collapse, this option can effectively be ruled out as well. Some cosmetic moves in the area of restraint for fiscal 1981 can probably be expected, though.

3. Impose orthodox monetary restraint. Because the growth in bank credit is so wildly excessive, it might require interest rates substantially in excess of 20 percent for a while to break the bubble. Should interest rates go to such levels, widespread bankruptcies could be expected in thrift institutions and weak corporations. Hence, any dramatic move in this direction before the election is unlikely, but one should expect more cosmetic moves in this area.

4. Controls. By a process of elimination, one comes back to the controls option as the refuge of desperate governments that do not know how to deal with a crisis they have created. Until the Thatcher government, this was always the path followed in Britain—inflate; and when chaos strikes, go for controls. Once the United States was past the point of no return after 1978, the government locked itself into a situation in which controls became virtually inevitable given the attitude that painful economic correction must be avoided. Toward the end of February, not surprisingly, the trial balloon of the controls option was floated in a number of quarters, and it is highly probable that they will eventually be imposed. Their timing will depend on when the "crisis" becomes politically intolerable. There are two major types of controls that the US government could go for—wage and price controls and credit controls.

In short, the United States is faced with a true domestic crisis. Price inflation is still accelerating and the bond markets have ceased to function. Unless the economy suddenly turns down swiftly enough to break the inflationary momentum and credit demands, the authorities cannot for long maintain a policy of benign neglect. Since fiscal deflation is effectively out of the question, the authorities have no choice but further monetary tightening or the imposition of controls.

PRIVATE SECTOR SQUEEZE

The essential problem is that for several years excessive and clashing credit demands in the economy have been allowed to generate excess credit creation, excess money growth, and rampant inflation. The consequences of this in terms of massive speculation, collapsed bond prices, collapsing housing, and a sharply deteriorating position of thrift institutions means that the authorities will have to intervene whether they like it or not. If the public sector does not reduce its claims on the economy for credit and real resources, then the private sector must be forced to do the adjusting. The problem is that the current level of interest rates appears to be nowhere near high enough to squeeze out the private sector.

The essential rationale for controls is to squeeze out the private sector at a lower level of interest rates than would otherwise be the case. While one can debate the various effects of different types of controls, investors and businessmen must not lose sight of the real point of the exercise—to squeeze the private sector. Thus, an effective controls package must be painful, just as an effective credit squeeze through orthodox monetary restraint would be. The longer such policies are delayed, the more devastating will be their consequences.

Borrowers are going to be denied credit at some point, either by fiat or by interest-rate rationing or both. Since the corporate sector's financial deficit will be widening from its already enormous level, as the economy slows further and costs continue to escalate, a painful squeeze must lie ahead. It is difficult to see any way out of the bind that the corporate sector will be in. The strain will remain until a decisive economic downturn is created, inventory liquidation is triggered, and ultimately reliquification at a lower level of inflation and interest rates.

Wage and price controls represent a further risk to the corporate sector because in an election year following two years of lagging real incomes, unions will only buy the package if they clearly can see some gain to themselves. Therefore, one must be prepared for a controls program that allows wages to rise relative to prices. Thus, a further risk to the corporate sector's financial position exists on this score.

In effect, the real cutting edge in a private sector squeeze is to force a widening of the corporate sector financial deficit and hence cause an increase in its external borrowing requirements, while simultaneously reducing its access to credit. A combination of effective credit controls and wage/price controls, favoring the former, is a potent weapon in accomplishing this end.

The bond market collapse of 1980 is creating its own conditions for reversal since the government cannot allow it to go on indefinitely. As for wage and price controls, the bond market would probably react favorably to them in the short run because of its deeply oversold condition. Beyond the short run, the bond market reaction would depend on the effect controls would have on actual economic activity, inflation, and credit demands.

With regard to the economy, it is also very difficult to assess how deflationary controls would be. Credit controls would, if effective, clearly reduce demand. If wage and price controls favored wages, then overall demand might rise as the personal sector would probably be stimulated more than the corporate sector deflated. But if tough restrictions on bank lending were imposed, the increase in the corporate sector's deficit could not be financed and hence unemployment might rise rapidly as firms dumped labor and inventories and cut back on capital spending.

The point is that runaway inflation creates great risk, volatility, and instability. Ultimately it forces the government to act, and this adds to instability because one cannot know the timing of the intervention nor whether it will have the effects desired or whether the effect will be perverse. Moreover, the short-run effects are often in the opposite direction to the longer-run effects. For example, after President Nixon's August 15, 1971, package of controls, floating of the dollar, import surcharges, etc., the stock market rose for a few weeks and then fell sharply. Should we get another package, it could well involve a combination of many moves that might have conflicting effects.

DCE is an extremely important monetary concept. If the authorities were serious about containing and actually reducing inflation, they would monitor it and change either or both monetary and fiscal policy when it first becomes excessive. This would avoid the situation they are in now and were in in 1974: having to change policy too late. By reacting very late, they allow inflation to build up tremendous momentum, which ultimately forces them into extremely unpleasant policy changes that risk serious overkill. Politically, when the risk of overkill appears high, they are very likely to resort to controls of one or more types—wage and price, credit and foreign exchange, depending on where the symptoms of instability are most extreme. The imposition of controls does not necessarily mean that the ultimate economic correction won't be severe. Moreover, it leads to massive distortions that further complicate the distortions from inflation; they squeeze the private sector, whose health is required to supply the goods and services to ultimately bring prices down. Finally, the removal of controls sparks a major catch-up or free-for-all that creates a whole new set of problems, which in turn increases the odds of a new set of controls. It is thus that a country can slide down the slippery path of socialism ultimately to authoritarianism.

DCE is also a useful concept and indicator for businessmen and investors because it clearly points out where a country is heading with regard to inflation, balance-of-payments problems, and interest rate trends. It also provides a highly useful framework for analyzing government policy changes.

Postscript: On March 14, several weeks after this article was written, the president and the Federal Reserve Board announced a new anti-inflation package. The major point was to reduce bank credit expansion—an encouraging acknowledgment of its importance. It was unfortunate, however, that so much emphasis was placed on credit controls, since they will add to distortions in credit markets and, if maintained, create even greater problems for the future. It was also unfortunate that no serious effort was made to contract the public sector's claims on real and financial resources. Thus, as expected, the private sector once again will bear the brunt of retrenchment, adding to long-run inflationary pressures.

It appears at present that the monetary authorities are serious about credit restraint. If so, the inflationary bubble will burst and a serious recession will develop. The big question then is, Will there be another major reflationary effort, to be followed by another boom-bust cycle, leaving intact a very long-run trend of accelerating inflation? One cannot help but suspect that, should the economy fall apart and unemployment rise sharply, the battle against inflation will cease and all efforts will be turned to manning the reflationary pumps. Clearly, investors and businessmen should continue to track DCE. It will once again provide a good lead to the extent of effective credit inflation and renewed pressures on the US balance of payments, the dollar, inflation, and interest rates.

J. Anthony Boeckh has been the editor of Bank Credit Analyst for 12 years and is a director of the Free World Fund, a mutual fund specializing in international investments.