The Cayman Islands Tax Haven

Individuals and corporations seeking to protect their assets from the evils of rampant inflation and excessive taxation traditionally seek out those investments that will stave off both perils. This frequently means investing in assets outside of their home countries. As the last resort, however, bankrupt governments often take recourse to control or confiscation of all assets even though situated abroad. At some point, therefore, the investor might, if he is permitted, change his residence or nationality. Both are drastic steps, and those who do not presently wish to take them should look into the advantages of making overseas investments through a corporation domiciled in a tax haven—a country that has a nil or minimum tax rate and lends itself and its facilities to those wishing to carry on a business from within its borders or shores. Any territory that does not encourage freedom of trade from within, either by virtue of its laws or by custom, is not a tax haven, no matter what its tax rate is, and can be just as oppressive as a country with a high tax rate.

Before comparing the popular tax havens—the Cayman Islands, Bermuda, and the Bahamas—it will be useful to examine in detail the advantages of investing through a tax haven, in this case, in the Cayman Islands. There are no taxes on personal income, corporate profits, or capital gains; there are no gift taxes, no estate duties, and no death taxes in the Cayman Islands. Nor are there likely to be any such taxes in the future. Companies incorporated there enjoy the same tax-free status as individuals, regardless of the nationality of ownership

Just about any type of asset can be transferred to a Cayman corporation with the immediate advantage of avoiding heavy taxation in other territories. It should be noted, however, that transfers by Americans may be subject to U.S. excise taxes, or cause the recapture of income. Once assets are transferred to a Cayman corporation, income received from them is tax free in the Cayman Islands. Furthermore, once the company is established it may transact business in any part of the world. Cayman companies may, for example, purchase gold, silver, and other precious metals, make deposits in Swiss francs, purchase Swiss francs, deutsche marks and other currencies, deal in commodities, and invest in foreign real estate. Generally, however, the corporation is subject to income taxes and withholding taxes whenever it earns income in another country. The following examples illustrate how Cayman companies can be used to effect tax savings and capital growth.

Example 1: Let us assume an individual living in a high-tax area has the following types of assets:

Interest-earning deposit accounts

Shares in listed companies

Real estate

Commissions from contracts

At present he pays income tax on the deposit interest, on the dividends from the listed stock and on the contract commissions, plus capital gains tax on the sale of any stock and any real estate. Furthermore, in the event of his death all of these assets will be listed in his estate and subject to death duties. If the income were earned by a tax haven corporation from countries which did not tax that income, there would be:

- No income tax on the interest from deposit accounts.

- Withholding tax only on the dividends from listed stock.

- No capital gains tax on the sale of stock.

- No capital gains tax on the sale of real estate.

- No income tax on the commissions and royalties from contracts.

On death, however, the value of the corporation stock is includable in the decedent's taxable estate and is subject to death duties.

An individual who has established a Cayman corporation as his world investment base enjoys an important advantage in that his assets are then immune from the erosion of taxes and the confiscatory action of governments if it is earned free of tax. The Cayman corporation may invest on his behalf in any part of the world and, instead of reinvesting only the after tax portion of the accrued profits, may continually reinvest the whole of the profits. This important aspect may also be illustrated.

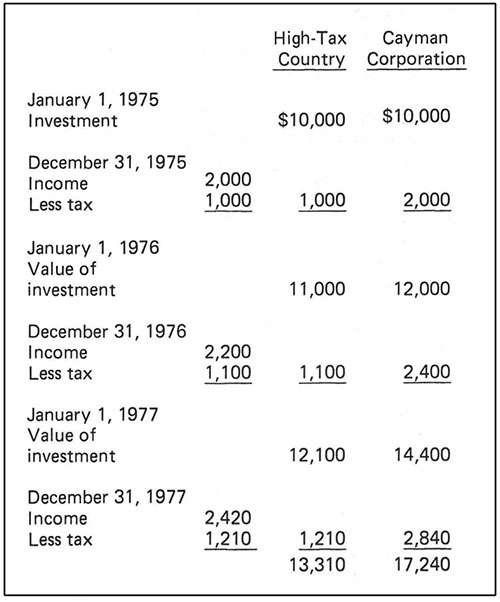

Example 2: Assume an annual profit of 20 percent and a domestic tax rate of 50 percent. Then the same initial investment will turn out as follows:

If continued for 10 years, the investment made by the Cayman corporation would be worth $61,917, more than three times the $25,937 profit made in the same period by the individual subject to tax.

There is virtually no investment situation that cannot benefit from such an arrangement. The owner of the Cayman corporation is free to remain in his country of origin or travel from place to place enjoying the assets held by his Cayman corporation, wherever they may be.

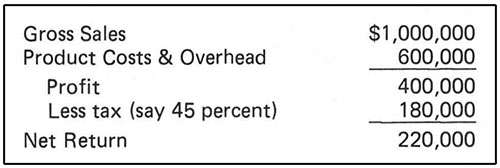

Example 3: Individuals and companies that import and export goods can derive great benefits from the use of a Cayman corporation. Let us assume a corporation (World Export Corporation) manufactures products for export at a cost of $600,000 per annum. The corporation sells its products in South America, Africa, and Australia. The gross sales amount to $1 million. Tax is payable on the income of World Export Corporation as follows:

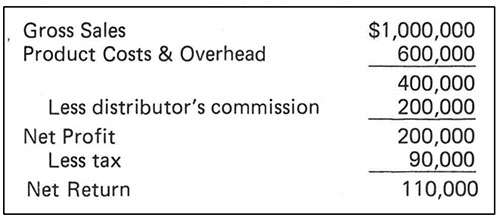

The situation will be greatly improved if the corporation enters into an agreement with a Cayman corporation whereby the latter is appointed distributor for the products of World Export Corporation throughout the world. Let us assume the Cayman company is called Overseas Export (Cayman), Ltd., and this company handles the whole of the export business of World Export Corporation for an overall commission of 20 percent. (This arrangement cannot, however, be used by U.S. citizens or residents who are subject to subpart F of the Internal Revenue Code.) The net return to World Export Corporation will now be as follows:

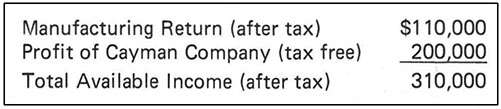

The total available net income will now be as follows:

It will be seen that after tax planning, $310,000 net income is available instead of only $220,000.

OTHER TAX CONSIDERATIONS

The foregoing examples have been simplified and do not take into account specific anti-tax-avoidance legislation that has been enacted in some countries. Although many of the operations set up in tax havens rely upon secrecy, others cannot and must make proper use of international tax planning within the framework of any legislation applicable. With regard to the United States, for example, a U.S. citizen is required by law to reveal his interest in a foreign corporation. Broadly speaking, a corporation formed in a tax haven but having more than 50 percent of its shares owned by U.S. citizens, each of whom own 10 percent or more, would be deemed a "controlled foreign corporation." The effect is that the U.S. shareholders are obliged to include certain types of the company income in their own income for tax purposes. Of course, this still leaves some types of income that are exempt from this rule or allows structuring the ownership so that it does not fall under the controlled foreign corporation definition. One way to do this is to set up a discretionary trust in a tax haven whereby it owns more than 50 percent of the shares of the corporation. In the correct circumstances this will negate the problem of the controlled foreign corporation. A further advantage will accrue if a foreign grantor creates the trust, since the foreign grantor has no reporting obligation to U.S. authorities.

The various permutations of situations are infinite, and there is almost no transaction that would not benefit from the use of a tax haven. In many territories, however, competent professional advice must be obtained concerning the correct structuring. As stated by the U.K. Judge Lord Clyde, "No man is under the smallest obligation moral or legal so to arrange his legal relations to his business or to his property as to enable the inland revenue to put the largest possible shovel into his stores."

COMPARATIVE ADVANTAGES

A tax haven should possess the following qualities:

- Complete freedom from taxes.

- A good political and racial climate. Racial environment not only applies to the national makeup of the territory's own population but also refers to the acceptance or otherwise of different races or nationalities within its borders.

- Freedom from exchange controls.

- Expertise in financial areas.

- Good telephone and telex communications.

- Good air and sea communications to international airports and seaports.

- Clear, flexible, and modern laws.

There are many different types of tax havens, but the ones to be considered here are the "nil tax areas"—those tax havens with no form of income tax whatsoever. The most popular of these are the Cayman Islands, the Bahamas, and Bermuda.

The Bahamas are independent members of the British Commonwealth and are a popular base for offshore companies. There has been a growing uneasiness among such investors, however, due to the symptoms of political and racial unrest that show themselves from time to time. High unemployment and crime rates help to antagonize this situation. Work permits are expensive and difficult to obtain for foreign staff, which does not help efficiency. Also, an increase to U.S. $1,000 in government minimum fees for the registration and annual licensing of a corporation adds to the expense of operating from this area. The communications are excellent, however, with good sea and air connections and direct telephone dialing to the United States.

Bermuda is a self-governing colony located in the mid-Atlantic. It also has extremely good communications. But Bermuda too has shown signs of political unrest, which has been attributed to the possible influence of a "black power" movement from outside the islands. A number of the professions and financial institutions are monopolized, and this has led to a general slowing down, together with increased costs, of services rendered to offshore investors.

The Cayman Islands, with a population of only 13,000, enjoy a stable political and racial situation and there is virtually no crime. Work permits are reasonably simple to obtain for qualified staff, so efficiency is not impaired and costs are not artificially inflated. Government fees are also reasonable. The Cayman Islands are considered by many experts the most desirable base for offshore operations.

LOCATION AND DESCRIPTION

The Cayman Islands are situated in the Caribbean Sea 500 miles south of Miami, Florida, and 200 miles north of Jamaica. They are comparatively far-removed from their neighbors. Trinidad, for example, is over 1,000 miles distant and takes longer to reach by air than London and New York. There are three islands, Grand Cayman, Cayman Brac, and Little Cayman. The largest, Grand Cayman, is 24 miles long and ranges from 4 to 8 miles wide. All the islands are generally low-lying except for Cayman Brac, which possesses a 150-foot limestone bluff. Grand Cayman has some of the most beautiful beaches in the world and therefore enjoys a healthy tourist industry. The islands are in fact the peaks of a subterranean mountain range and are renowned as one of the world's centers for snorkeling, scuba diving, and deep sea fishing.

The Cayman Islands enjoy a semitropical climate. From May to October the temperature ranges from 70°F. to 85°F. Also, most of the rainfall (60 inches) falls at this time of the year. The temperatures are generally 10 degrees cooler during the dry months, November to April, and needless to say, most of the visitors come at this time. The hotels tend to be crowded from January through April, and prices are somewhat higher. Persons contemplating a visit to the islands would therefore be advised to avoid these peak months.

Most of the population—10,000-live and work in Grand Cayman. There are no indigenous natives. The islands were first settled by shipwrecked sailors, adventurers, and buccaneers of British origin. Later, escaped slaves from the various shipwrecks landed on the island and made a home there. Today the population comprises roughly 20 percent direct European descent, 20 percent direct African descent, and the remainder of mixed parentage. The islands enjoy unmatched racial and political harmony, and the underlying factor is probably the general wealth, which is fairly evenly distributed amongst the people whatever their background. This wealth has been brought about by the long history of full employment, occasioned at first by the seagoing careers of the Caymanians, then by the tourist industry, and now by the tax-haven industry. The Caymanians have never been politically conscious, probably due to their individuality and high standard of living. There are, in fact, no political parties nor any trade unions. The islands are a crown colony, and the people, who are very patriotic, prefer life this way. There is no move toward independence, and the inherent stability of the islands provides an important advantage for the investor.

SERVICES

Transport to and from the islands is by air. LACSA, the Costa Rican airline, and Cayman Airways use BAC-111 jets for flights to Miami, Jamaica, and Costa Rica; Southern Airways, a U.S. carrier, uses twin jet DC-9's for a daily shuttle to Miami. Most travelers to Cayman travel via Miami, and there is an average of two arriving flights per day from Miami. The trip takes one hour. Several hotels, including Holiday Inn, provide accommodation of a high standard, and some have European cuisine.

Telecommunications, which were a drawback in the past, have now been vastly improved by Cable & Wireless, Ltd. Direct telecommunications are available to the United States and Europe via a new underwater cable connected with the international communication system in Jamaica. Many companies have installed telex facilities and a good cable service is also available. Mail takes one to two days to the United States and two to three days to the United Kingdom.

A host of commercial banks provide access to most of the money markets of the world. There are several good legal firms, and a number of international firms of chartered accountants are represented on the islands.

The official tender in the Cayman Islands at the time of going to press is Cayman Islands dollars, although American, British, and Canadian currencies are honored and readily accepted. The official rate of exchange is CI$1 for U.S.$1.20. A company or person regarded as nonresident for Exchange Control purposes may maintain accounts in foreign currency without restriction. Most companies registered in the Cayman Islands are nonresident for Exchange Control purposes.

POLITICAL STRUCTURE

In spite of their status as a crown colony, the islands enjoy a large measure of internal self-government in that the legislative assembly and executive council are largely composed of locally elected members. The assembly meets to make the laws of the islands, which are based on English common law, and the executive council meets weekly to decide on matters of policy and the administration of the law. Her Majesty, the Queen, is represented by the governor, a British civil servant, who is chairman of both the legislative assembly and the executive council. He does have a power of veto but has never had to use it, just as the Queen has never had to exercise her power in Britain.

Judicial power is exercised by a stipendiary magistrate, who presides over the courts in George Town and, when necessary, in Cayman Brac. The grand court, quarterly petty court, and petty sessions court are the courts of the Cayman Islands. Law enforcement and guidance are exercised by an attorney general and the police force, which is administered by a British colonial official. No military establishments are located on the islands.

The revenues of the islands are derived from indirect taxes, such as import duties and a stamp tax. One of the most important features of Cayman as a tax haven is that there never have been any taxes. The absence of income tax is not, as it is in some territories, an artificial absence created by legislation, but a natural one—the islands have developed without the concept. The idea of income tax would therefore be repugnant to the people. This absence of taxes, together with political and racial stability, has attracted the attention of investors seeking a tax-free base for their operations. The government is aware of this attraction and in recent years has encouraged investment by deliberate modernization of laws and development of the financial sector. Government policy is aimed at continuing support of this sphere of the islands' economy.

Another important factor, often overlooked by even quite sophisticated financiers, is that the Cayman Islands, having no taxes, are not parties to any tax treaties with foreign governments and are therefore not obliged to exchange information. This is strengthened by the secrecy provisions in the banking law of 1966, which makes the disclosure of a client's business by an officer or staff member of a bank a criminal offense. Since some investors rely entirely upon secrecy to safeguard their offshore companies and business dealings from outside interference, these features are very important. In this the Caymans have an advantage over many tax havens, including Switzerland.

CAYMAN COMPANIES

Companies formed in the Cayman Islands are either ordinary or exempt, and are either resident or nonresident for Exchange Control purposes. Ordinary companies are formed in much the same way as they are in England. A Memorandum of Association, to which at least three subscribers are required, must be filed with the Registrar of Companies, stating the name of the company, the situation of the registered office, the objects, and the authorized share capital. The company may either draw up its own Articles of Association or use the standard "Table A." The company must at all times have a minimum of three shareholders. An ordinary company must have at least one director and is required to hold at least one shareholders meeting every year. It must also file an annual return with the Registrar of Companies, listing the shareholders and officers.

An exempt company is formed in the same way except that a director must make a declaration to the effect that the company will not trade within the Cayman Islands for any reason other than the maintenance of an administrative office. An exempt company enjoys the following advantages:

- It may obtain a guarantee from government exempting it for up to 20 years from any taxes which could be introduced by future legislation.

- It may issue bearer shares, title to which may be transferred by mere possession.

- It need not keep a register of shareholders.

- It need not file an annual return.

- It need not hold any shareholders meetings.

A resident company is one whose shareholders are residents of the Cayman Islands and that transacts most of its business within the islands. It cannot sell its shares to nonresidents without permission nor can it hold foreign currencies without permission from the Exchange Control authorities. Overseas investors are not normally concerned with resident companies.

A nonresident company is one whose beneficial owners reside outside of the Cayman Islands and that transacts most of its business outside of the islands. A nonresident may hold shares in such a company, and the company itself may hold foreign currency accounts without permission both within and outside of the islands.

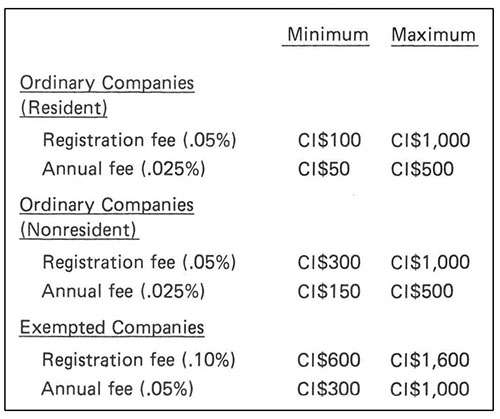

In view of the fact that there are no taxes in the Cayman Islands, nor are there likely to be any in the future, there is little to choose between an exempt and an ordinary company, except that the cost of forming an ordinary company is far less. The government fees for forming a company are based on a percentage of the authorized capital and work out as follows (with the percentage basis indicated):

OTHER COMPANIES

Under the bank and trust companies licensing laws, no company may include the words "bank" or "trust" in its name or carry on banking or trust business without obtaining a license from the governor. The law imposes certain conditions on companies wishing to transact this type of business, the most important being the provision of a manager who is well versed in banking and financial matters and the setting aside of a fully paid up capital of CI$200,000.

A foreign corporation may register an office to carry on business in the Cayman Islands. The initial government fees are CI$300 and the subsequent annual fee is CI$150.

There are presently no special statutory requirements regarding insurance companies except in the case of those wishing to insure local risks.

ESTABLISHING A CAYMAN COMPANY

The easiest and least costly way to form a Cayman company is by mail, through one of the management companies established in Cayman especially for this purpose. The incorporation service normally includes the provision of Memorandum and Articles of Association, company seal, name plate, minute book, and statutory records and deals with all the incorporation formalities. The client merely has to provide:

1. The desired name of the company. Three choices are normally requested in case a given-name is already in use.

2. The names and addresses of proposed directors and shareholders (unless confidentiality is required, in which case the management company will provide local nominees).

3. A remittance of US$800 for an ordinary company and US$1,300 for an exempt company.

The management companies also provide annual management services and supply local directors and shareholders for fees starting at US$250 per annum.

WHY TAX HAVENS, ANYWAY?

None of what has been said above is meant to imply that tax havens or the institutions operating in them wish to encourage foreign nationals to avoid normal government controls to which they are subject. Those institutions only have a responsibility to abide by the laws of the country in which they are operating, however. Furthermore, they recognize the need and the right of an individual to protect himself from tyranny. Even recent history has shown the hardship that has been inflicted upon millions who did not take sufficient precautions to protect their wealth.

Consider, for example, the plight of the White Russians forced to leave Russia during the 1917 revolution, or the position of the German Jews who had their property confiscated by their own countrymen just prior to the Second World War, and, ironically, the fate of the Nazis who found themselves in exactly the same position at the end of the same war. Consider the victims of Castro's revolution in Cuba, many of whom were forced to start life anew in Florida with all of their savings confiscated. Consider, within the 20th century, India, Malaysia, Korea, Spain, and Hungary, and, within the last 10 years, Bangladesh, Vietnam, Ireland, and Uganda. Consider also that the continent of America was settled by the Pilgrim Fathers—people who had to leave their country to establish a new one if they were to live in peace with their own ideas. What is it that the Americans are celebrating in their Bicentennial year if it is not their liberation from the tyranny of taxes of 200 years ago?

One of the original pioneers of the Tax Haven Industry in the Cayman Islands, Paul Harris was the first British chartered accountant to take up residence, arriving from London in January 1967. Now a Caymanian citizen, Mr. Harris was for five years a resident partner in an international accounting firm and for two years president of a private bank. He has served on the council of the Cayman Islands Society of Professional Accountants and was secretary to the Cayman Islands Chamber of Commerce for eight years. In addition to various articles for financial publications, he wrote and published the first two editions of The Cayman Islands Handbook and Business Guide, which is now accepted as an authoritative work on the islands. His latest works are "Cayman Islands Bank and Trust Company Directory" and "A Concise Guide to the Cayman Islands Companies Law." He is presently managing director of International Management Services, Ltd., a consulting firm specializing in the formation and management of Cayman companies.