Can You Beat Inflation?

The unhappy news is that no general escape from inflation seems to exist. The reason for this is that inflation requires the citizen to protect himself through speculation. Since there is a loser on the wrong side of every successful speculation, the nation as a whole cannot hope to escape the damage of inflation through speculating. In fact, since inflation is a disease in the money system (not in wages, not in doctors' bills, not in oil prices, but in the monetary system), there is no way to escape the disease other than to escape from the money itself—remove your capital from the monetary circuit.

This is, to some people, a bitter pill to swallow. They have grown accustomed to the "game" of beating inflation. Either they are happy speculators or they are thriving adventurers who publish books on "survival" by retreating into the wilderness and planting a vegetable patch while holding the barbarians at bay with their trusty flintlock. Such grotesque advice does not amount to beating inflation at all: one has simply preserved one thing—a pile of silver and gold coins, or a handsome Swiss bank deposit—at the expense of something else: one's standard of living. The more difficult question is whether you can beat inflation while maintaining your standard of living. Since the question is difficult, it is ignored by the quacks and the sensationalists. Let us leave them up there in their huts in the North woods, with their tummies aching from too much raw food, and their longing to be back again within a 10-minute drive of a doctor's office. If they call that "survival," God bless them.

INVESTMENT SURVIVAL

No, an investment adviser should speak of investment survival. The historical record is not silent on the subject; indeed, inflation and the destruction of paper currencies are the general rule of economic history. The best-recorded, longest, most recent, and most instructive example is the French inflation between 1914 and 1958. In this period the "M1" money supply (hand-to-hand currency plus demand deposits) multiplied by a factor of 632. This great increase in nominal demand caused a great rise in prices. Construction costs in Paris went up by a factor of 320. Labor costs went up by a factor of 300, wholesale prices by 205, retail prices by 200, the official gold price by 190, the stock market index by 80. Selected gold coins went up by a factor of 280, doing 50 percent better than gold bars. Genuine antiques did best of all.

Real estate? Ever since the Pilgrims came to shore, we have seen real-estate boomerism at work in America. The average American, even today, thinks real estate is the "best hedge" against inflation. Not so. The French experience shows that urban real estate suffered tremendous losses from deterioration—of properties under rent control (and controls always arrive when the inflation begins to hurt), and that agricultural real estate was even trickier because of the unpredictable effects of farm subsidies on land values.

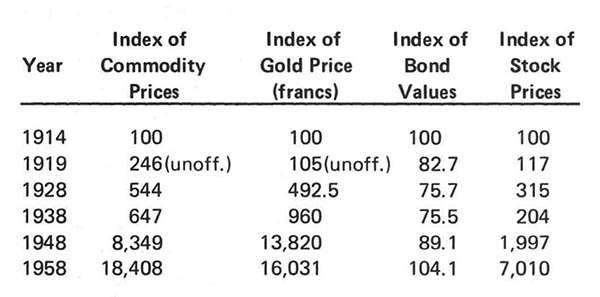

A few more numbers:

Think about those numbers for a moment. The experience with the gold price looks rather attractive, doesn't it? But remember that you would have to hold your wealth in this form for 30 or 40 years without receiving a sou of income, and in fact it would have cost you money to protect and store your holdings. This is not an "investment" to "beat" inflation, but an emergency procedure for avoiding catastrophe. And it is not fool-proof. Suppose you rightly understand the situation and put everything into gold bars. Suppose you erroneously decide that the inflation has ended and you sell your gold bars and put the proceeds into financial assets, or real estate, or any of the very numerous inferior investments. You will lose your shirt after all; thanks to gold, you will lose a larger shirt.

Are there some common stocks that do better than others? Quite obviously yes. Between 1914 and 1938 the following groups did better than the price index: insurance companies, miscellaneous mines (can you guess why?), chemicals, textiles, gas and electric companies, and colonial and overseas enterprises (guess why?). And the following did worse: banks, coal mines, forges and foundries, metals and machines, shipyards, construction materials, rails, transit companies, navigation, miscellaneous industries, and merchandising.

EFFECT OF GOVERNMENT

Many of the distinctions between industries should be attributed to the governmental and bureaucratic institutions affecting the industries. Nevertheless, the fact that such great differences did exist is highly suggestive. We see the same results in the United States, with some industries prospering and some stagnating under a government ostensibly dedicated to "the general welfare."

Again, between 1938 and 1958 the commodity index went up by a factor of 28 and the gold price by a factor of 16.7. In the same period oil and gas stocks went up by a factor of 168, mines by a factor of 29, metallurgy by 52, machine tools 32, automotive and accessories 31, construction materials 29, chemicals 24, food manufacturing 20, textiles 30, transportation 36, department stores 42, miscellaneous industries 37, banks 32, mortgage credit 39, insurance 41, and holding companies 32.

Note the tendency of "financial" stocks to keep up with inflation. The reason isn't hard to find. Inflation is an increase in the money supply. Some companies, such as insurance and bank companies, do nothing but handle contracts in "face amounts" of the money supply. As inflation continues, you hear the insurance salesman telling you that you need more "coverage," and you find that your bank balances tend to be "higher." These quantities are the same quantities that enter into the revenues and profits of the companies. So they have an inbuilt tendency to offset the effects of inflation. But don't leap to conclusions. Banks and insurance companies are closely regulated in the "land of the free." Banks invest in bonds, and bond prices go down (see the index of bond values between 1914 and 1958, showing a loss of almost 100 percent of the purchasing power). Insurance companies can be hit with a rash of contrived "catastrophes" as the inflation overturns normal business operations. Towards the end, when speculation twists the judgment of bankers themselves, you will find a growing number of bank failures (note, in the present time, the failure of Salik Bank, Herstatt, Franklin National, San Diego).

SOME TACTICS

It is evident that there is no royal road to shelter from the effects of inflation. I can think of four principal tactics, not one of which is truly comfortable: 1) try to make above-average investments in domestic companies; 2) try to make merely average investments in foreign companies domiciled in countries with stable currencies; 3) buy gold; 4) reform your domestic monetary system.

As for investment in foreign countries with stable currencies—forget it. For various reasons every currency in the Western world is going downhill at least as fast as the dollar.

I advise buying gold or gold mining shares but gold can be confiscated and mines can burn up or be flooded, and I think it is prudent to limit your risk by limiting your gold position to 30 to 40 percent of your portfolio. What to do with the rest?—good question and beyond the scope of this article.

As for reforming the monetary system, I see no possibility of that until the politicians, and the deluded masses who vote for them, learn that inflation is a disease that appears to do some visible "good" while it does infinitely greater damage that remains for many years quite invisible. Our entire political system is built on the assumption that inflation can go on forever, and ever faster and faster; to correct this delusion we must reform our entire political system; do not hold your breath in the meanwhile.

William F. Rickenbacker is editor of the Rickenbacker Report, an investment advisory letter, and publisher of the Financial Book Digest. This article is copyright 1974 by Private Practice, from which it is reprinted.