The Pay-What-You-Want Tax Plan

Everyone agrees taxes are unfair. For most people they're a back-breaking burden—a family earning $10,000 pays $4,800 a year in federal, state, local, hidden and excise taxes. Working one to three days a week for the government, in this way, is regarded by many as a sophisticated and subtle form of involuntary servitude. In the eyes of some, taxation is legalized theft—particularly when it funds programs those individuals oppose. Many small businessmen feel they are being squeezed unmercifully out of the market place by an unjust tax system.

Is there any realistic way to eliminate much of the abuse of our present system of taxation, without chaotically disrupting government? The SPEAK OUT! organization thinks this objective is attainable, by implementing its innovative proposal: The PAY-WHAT-YOU-WANT TAX PLAN.

THE PAY-WHAT-YOU-WANT TAX PLAN promotes more citizen involvement in the affairs of government. It makes taxation 80% voluntary. It better reflects participatory democracy than the current system, because, presently, Congress and the President can cut off each other's funds without consulting the guy who pays. Taxpayers remain, to a large extent, voiceless.

Budgets have become so astronomical that power plays by politicians seldom evolve around ideas but, instead, around the dollar.

SPEAK OUT! simply believes that alternative means and ideas must be devised so that power can be restored to the individual citizen. Our tax plan would not only make government spending more accountable, but would also democratically provide alternative solutions to many social issues. Although the description of this plan deals with its application on a federal level, it should be emphasized that the concept would apply also to state and local governments as well.

HOW IT WORKS: I. The Rebate Phase

1. The first year, 1974, you pay your usual tax based on the old system to give government agencies a grace period of 12 months to prepare for and adjust to any possible decrease in revenues from the plan when it goes into effect in 1975.

2. Let's assume that the tax you pay under the old plan is $2,000.

3. You simultaneously pay your 1974 tax and fill out your new Pay-What-You-Want tax form. Of course, you do not pay your 1975 tax fee until 1975, a year later.

4. The amount you pay on your new 1975 form is 20% less than your 1974 tax, or $1,600. This is because the entire federal budget has been reduced 20%—by law—and the savings has been passed on to you. This is why this phase is called the "Rebate Phase."

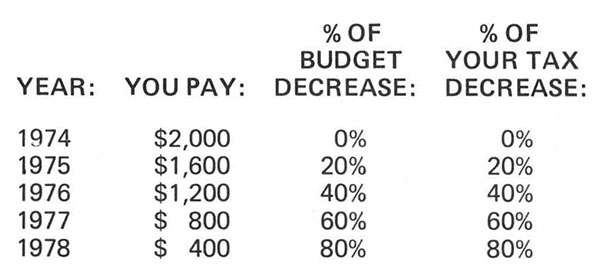

5. Your tax will be decreased 20% of your 1974 tax each year for four years. The amount you pay each year would be as follows:

6. You can choose to keep your net savings, or allocate all or part of it to one or more government agencies voluntarily, if you wish, in the "new" tax form.

7. Eleven broad categories of government departments would present, in this new tax form, their reasons why you should support their department with your voluntary payments. They would explain and justify their past and present records and performances and define their goals. Opposing points of view will also be presented, but more about this later.

GOVERNMENT AGENCIES: AN OPPORTUNITY FOR GROWTH OR PHASE-OUT

The table above demonstrates the maximum amount that a given agency's budget could be depleted in the rebate phase. Since your 1974 tax is paid in full under the old system, and since the cutbacks are gradual, it should be evident that this is not an attempt to do away with any government function. In fact, it is an attempt to restore integrity, accountability and fiscal responsibility to government operations, and, under the pressure of the threat of potential revenue loss, spur them to more clearly focus on their objectives, methods, expenditures and eliminate waste and red tape. The plan will also require those agencies, who are somewhat unclear about their purpose, to develop ways to define themselves to the American public.

In addition, it can be seen that if each category of government is able to state its case persuasively, and with reason in the new tax form, and citizens voluntarily contributed enough dollars, some, or all, department revenues could increase—rather than decrease. The tax plan is not a choice between government providing services and no one providing these same services. The technology, skills, creativity and productivity of the market is ready and waiting in the wings to compete for citizens' newly acquired cash resources through the Rebate Phase and propose ways and means to provide these functions cheaper, better and faster. It may also be evident, from the "Referendum"Phase" described below, that Congress may decide to completely phase out a particular department because the public will have voiced, through the tax form, a mandate that it has outlived its usefulness.

II. The Referendum Phase

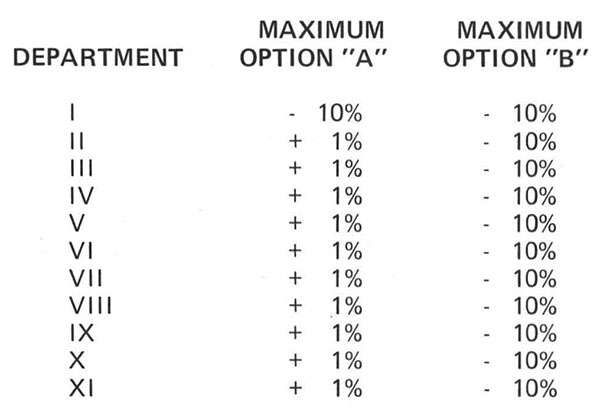

Through this second major phase of the plan, some government agencies would have an opportunity to recoup their 1975 20% budget cut. This phase also provides the means for the taxpayer to express preferences for particular agencies and guide Congress on appropriations for the following year on eleven government departments. It further enables taxpayers to not only cut the budget of an agency they do not approve of by an additional maximum 10%, but also add 1% to 10% to another agency or agencies whose functions they do want to support.

Let's examine how one department might gain or lose under the "Referendum Phase." The Department of Defense's current budget is $70 billion. On the basis of the 1975 automatic 20% cut in the "Rebate Phase", it would be $56 billion. Taxpayers could also choose to cut the department's 1976 budget another 10% to $50.4 billion. Other departments might have an opportunity to gain and divide that 10%. The table below shows how, if the Defense Department was "Department II", and all taxpayers voted alike, their budget would increase 1% under Option "A". Under Option "B", however, if all taxpayers voted alike, the Department of Defense would stand to lose another 10% on top of the 20% rebate cut. The taxpayer would have a variety of options to decrease or increase any specific agency's budget. The maximum decrease a taxpayer could subtract from any department would be 10%. The amount of the decrease could be added to another department (Option "A") or he could subtract 10% from all departments (Option "B"):

In between Option "A" and "B", of course, are a variety of many other options for allocations and subtractions as long as no government department is penalized more than 10%. The computerized results of your and all taxpayer preferences each year would compile a "priority" consensus to instruct Congress on how future tax revenues are to be allocated.

III. The "Public Debates Through the Media" Phase

Each government agency must allocate ½% to 1% of its total budget each year for four years to public debates, through the media, about the necessity of its expenditures. However, no more than ½% can be spent by a department on its own promotion. For example, if the Department of Defense's 1974 budget is its current $70 billion ½% of its total budget, or $350 million, will attempt to persuade the taxpaying public that the way it spends money is sensible. The department will utilize any media it believes best tells its story and persuades the taxpayer that it deserves their rebates and "vote" in the referendum.

It may also choose not to state its needs to the public through the tax form or through the media, and instead use the $350 million for departmental expenses.

On the basis of the fairness doctrine "equal time" concept, the remaining ½% or $350 million, must be provided to opposing groups (such as peace and anti-draft organizations) to present their side to the American public through the media. Their case, for instance, may be that funds should be totally or partially cut due to waste, inefficiency, incompetency or that the specific department be abolished. Program time or advertising could be bought jointly by both sides for the sponsorship of debates through broadcast programs or commercials or print ads.

Over $2¾ billion would be spent in this way if all federal, state and local agencies participated. If they didn't their survival, of course, could be threatened by opposition arguments. This total outlay, $2¾ billion, is more than half that spent for all commercial advertising. Yet billions are wasted each year by the government in overpayments in military contracts, interdepartment warfare, unnecessary paperwork, and inter-office memo writing to justify and protect bureaucratic responsibilities and civil service inefficiencies. This plan motivates these agencies to turn that kind of unproductive work into more important justifiable activity: defending themselves to the taxpayer and demonstrating that what they do is indeed worth the cost.

ITS IMPLICATIONS FOR A BETTER SOCIETY

Our proposal is more than a tax plan. It gives Americans an option for a more positive, democratic, productive, fair, voluntary and rational society. As an example, let's take public education on all levels—elementary, high school and college. Some Americans would undoubtedly choose to financially support the present system. Others would choose to utilize their rebates to shop for free market alternatives: private, religious, or public schools that offer more community control. But public education, with pressure of the rebates and referendum and with the new threat of competitive forces, would be compelled to improve; to become more productive, increase quality, and become more responsive to social and community needs.

There are other examples. With more individual control over the country's economic resources, wars could no longer be financed without taxpayer approval. Those who are too young to vote but are nevertheless taxed for their full or part time work would now have a voice in government affairs. Political promises to control crime would now have to be backed up with deeds instead of words, or citizens might use their rebates to buy private security guards.

More funds might become available to private drug and child care agencies if State agencies continued to fail in their efforts. If people really wanted a cleaner environment, they would now have the power, through their rebates and the referendum, to vote it in. If the American taxpayer is fed up with subsidizing pressure groups, and special interest groups, and tired of fattening the pockets of corrupt politicians and of those who collude with them, he now has an alternative to the powerlessness that formerly immobilized him.

"IT'LL NEVER HAPPEN"

That's the comment SPEAK OUT! hears most. These are other comments: "It's too logical, and too sane for an insane world" "People are so hopeless, so apathetic, so docile, so fearful, so despairing and so mistrustful they'll laugh at a plan that promises them more freedom. People don't want to be free. Freedom is too scary. They want to be manipulated, controlled and told, as children, what to do and what's best for them."

SPEAK OUT! has also been told: "You can't trust people to make decisions that are in their own best self-interest. You have much more faith in the ability of the American public to reason than I". It's true. SPEAK OUT! does hold people in high regard. SPEAK OUT! believes people do possess the capacity to exercise more control over their own lives and make rational choices through this tax plan. Through the media, people can speak intelligently and persuasively to each other and to the government; and government can speak rationally to them.

The plan has the endorsement and support of prominent thought leaders including Dr. Walter Block, Assistant Professor of Economics, Baruch College, C.U.N.Y.; Dr. Nathaniel Branden, Psychologist and Author; and Dr. Murray Rothbard, Professor of Economics, Polytechnic Institute of Brooklyn; and others.

It is not possible to hold the answers now to all the detailed questions and objections that might arise about the plan and how it might affect thousands of programs and a complex giant bureaucracy that took over 200 years to create. That is a responsibility that should be shared by other groups, philosophers, economists, lawyers, sociologists and political scientists. If destructive patterns and institutions exist, SPEAK OUT!'s objective is to raise consciousness about these issues and help people present their views about alternatives via the media. SPEAK OUT! believes the PAY-WHAT-YOU-WANT TAX PLAN poses just such an alternative.

John Zeigler is Executive Director of SPEAK OUT!, a non-profit, tax-exempt organization dedicated to helping people present their views about public issues in all media. He was the subject of an exclusive REASON interview, "Advertising and Social Change," in REASON's October 1972 issue.