Money: Investing in Diamonds

Americans, blessed with a stable currency and well-developed capital markets, look down their nose at foreigners who scramble to put their pathetic little pesetas and dinars into gold and diamonds. Poor devils, we say, they know nothing better. We (thank goodness) have mature and liquid stock markets, magnificent engines of capitalism, to nurture and multiply our wealth. Since 1964 we have seen our Dow Jones Industrials go from 800 to over 1000!

One problem with comforting figures like the Dow Average is that we tend to forget about inflation. If we allow a modest 4% p.a. compound rate of inflation from beginning 1964 to beginning 1973, we would find that the Dow should be at about 1138, just to allow for inflation. Too bad about that.

As everyone knows by now, gold has doubled over that same period. What you may have missed in the fact that top grade diamonds have trebled in price over the same period.

The investor who wants to put a bit of his savings into gem-quality diamonds has a few problems: he generally does not know what he is buying, how much it should cost, what to do with it after he buys it, where to sell it if he wants to liquidate, or what price he should expect on resale. Not surprisingly, this discourages many people from investing in diamonds.

CARAT WEIGHT

There are diamonds and then there are diamonds. Diamonds are distinguished by their weight, which may be expressed in points or carats.

1 point = 2 milligrams

200 milligrams = 1 carat

142 carats = 1 oz.

Weight is the simplest part of the diamond trade. Either a stone has a certain weight or it doesn't and you can always weigh them.

CUT

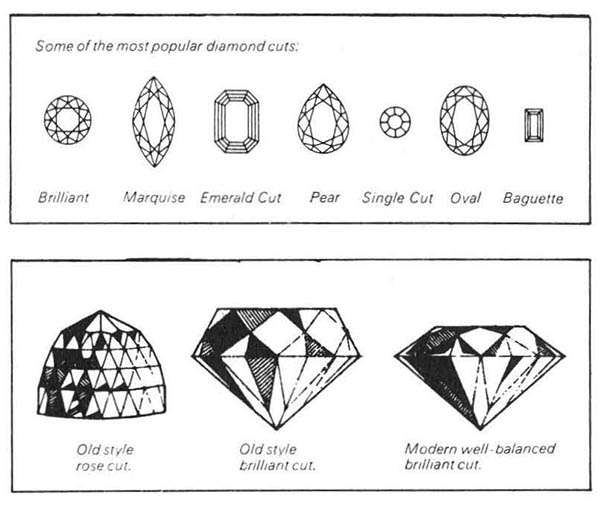

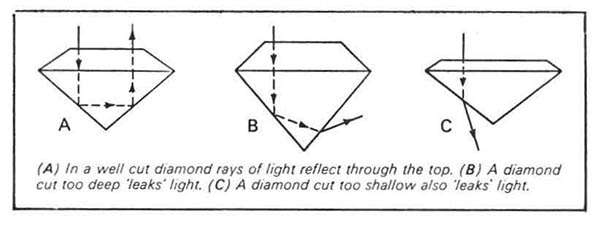

Rough stones are cut into various shapes, generally for aesthetic appeal, but also for reasons dictated by the demands of the market and the shape of the rough stone. The cut determines the play of light through the stone. The accompanying illustrations show the more popular modern and old-style cuts. The cut of a stone is an important factor in determining its value.

MAKE

Make describes the perfection of the diamond's cut. It also is important to the stone's value.

As a point of information, most stones today are cut by sawing with a thin blade coated with diamond dust and revolving at a high speed.

COLOR

Color is the hardest quality for a nonexpert to appreciate. An experienced diamond sorter can detect several dozen shades of color in stones that a layman would say were all white. Needless to say, color is quite important in a gem stone.

The color problem is not helped in the least by the fact that there are five or six different systems of color designation. For example, a given stone might be called a Blue Wesselton (under the Old Name terminology), a G (under the Gemmological Institute of America system), a Rare White (under Scandinavian Diamond nomenclature), or a Fine White. In addition, the American Gem Society would rate it between a I and II.

CLARITY

Anything which hinders the passage of light through a stone, either an internal flaw or surface defect, diminishes its clarity. There are about 10 gradations of clarity within the class of gem quality diamonds. Once again, the higher the clarity, the better the value of the stone.

FOR THE CASUAL INVESTOR?

All of the foregoing present some problem to the casual investor. Some, such as color, are almost certainly beyond his competence to judge. If he buys a stone from one jeweler he may find when he goes to sell the stone that the buyer does not agree with his grading, and his price will suffer accordingly. He may also lack the contacts to sell his stone and have no idea what the market price is for a stone of his particular cut, weight, color and clarity.

On the other hand, diamonds do have a reputation as a desirable, profitable, and emotionally appealing investment—and this presents an obvious opportunity for an entrepreneur to supply an unmet need. And this is exactly what has happened in the diamond market.

Several London firms now offer gem quality diamonds of a guaranteed weight, cut, clarity and color, of a quality acceptable to manufacturing jewelers, in lots of various prices. These are offered to investors at published trade prices.

While dealers will generally ask for minimum orders of about $600, lots have gone for as little as $135. The purchaser may either take delivery or have them held in a London bank. The stones come sealed in a transparent plastic case and so long as the seal is unbroken the stones are guaranteed by the selling firm to be in all particulars as described. Prices are published periodically and the seller will broker the sale of the stones should the investor wish to liquidate his holdings.