Rand Paul's Plan to Balance the Budget by 2023 Will Get a Senate Vote This Week

Do Republicans have the guts to impose strict spending caps?

The Senate will vote this week—likely Thursday—on Rand Paul's budget plan, which would balance the federal budget by 2023 by cutting $400 billion next year and capping future spending increases.

Passing the Kentucky Republican's so-called "Penny Plan" would be a dramatic reversal for Congress, which earlier this year approved enormous spending hikes that busted Obama-era spending caps and threaten to put the country on pace for a $1 trillion annual deficits. The bill is not expected to pass, but Paul tells Politico that it will be a "litmus test for Republicans who claim to be conservative, but are only too happy to grow the federal government and increase our debt."

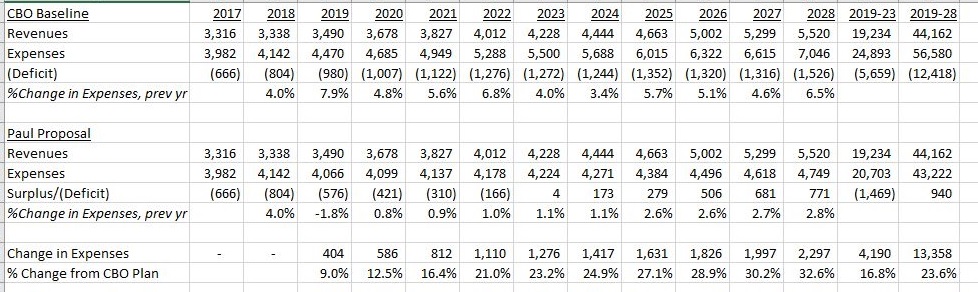

Relative to current baseline projections, Paul's proposal calls for a $404 billion spending cut in fiscal year 2019, which begins on October 1. After that, Congress would be required to cap spending increases at 1 percent annually. Over the next 10 years, Paul's plan would spend about $13.3 trillion less than the current Congressional Budget Office (CBO) projections—though federal spending would still increase by more than 14 percent over the decade.

Paul's plan would balance the budget by 2023, as long as revenue meets current CBO projections. By 2028, the country could be running a $700 billion surplus instead of facing the $1.5 trillion deficit currently projected by the CBO:

Paul's budget would require "some hard decisions now, and then a squeeze to force prioritization in future years," Joseph Bishop-Henchman, vice president of the Tax Foundation, tells Reason.

Is Congress capable of such fiscal restraint? Probably not. But some states have similar spending caps and mostly stick to them. New York, for example, has a 2 percent spending cap. Social Security would be off-limits for budget cuts, but Paul's plan is otherwise agnostic about what federal programs would face the ax to meet the new spending limits—and there is no shortage of targets.

Mick Mulvaney, director of the White House's Office of Budget and Management, reportedly met with some congressional Republicans late last month to discuss the possibility of clawing back some domestic spending in the $1.3 trillion omnibus budget bill that cleared Congress in March. Senate Majority Leader Mitch McConnell (R-Ky.) has dismissed that idea.

Combined with last year's tax reforms, the spending bill will produce annual deficits of at least $1 trillion for the rest of the Trump presidency, the CBO says. If Congress does not allow individual tax rate reductions to expire as planned in the middle of next decade, the deficit will balloon by another $722 billion. By 2028, the CBO projects the national debt will equal the nation's overall economic output, with our debt-to-GDP ratio reaching levels "far greater than the debt in any year since just after World War II."

Absent some surprising congressional move to re-litigate the omnibus bill, an overall plan to scale down spending, like the one Paul is offering this week, is probably the best—though faint—hope for anyone who wants to avoid trillion-dollar deficits for the foreseeable future.

"It would be a sea change in how Washington works," says Bishop-Henchman. "Cutting $400 billion is inconceivably large to most D.C. folks and improbable for a Congress that just did the opposite and voted a big spending increase."

Show Comments (97)