Tumbling Gas Prices Caused Inflation To Fall to 8.5 Percent in July

Prices for food and housing continued to rise but were offset by lower gas and energy prices.

In more normal times, an annual inflation rate of 8.5 percent would be catastrophic news.

Right now, it might be greeted with sighs of relief.

That rate, reported Wednesday morning by the federal Department of Labor in its consumer price index data for the month of July, is still miles above the Federal Reserve's target rate of 2 percent. Still, it represents a possible break in the fever of rising prices that has gripped the American economy for the past year—in June, annualized inflation rang in at 9.1 percent, the highest level in 41 years.

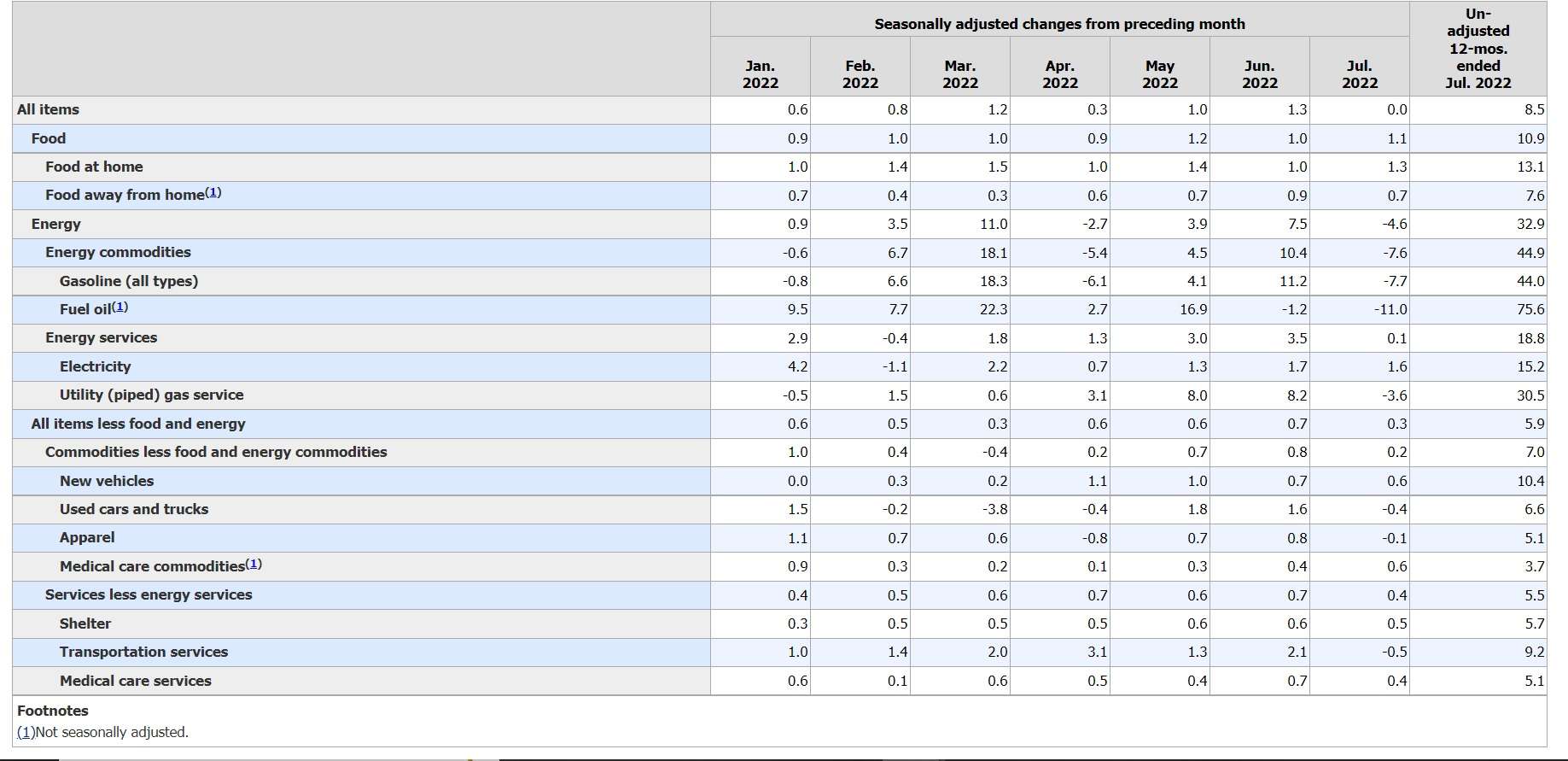

Tumbling gas prices were the primary driver of July's lower inflation rate. Gas prices fell by 7.7 percent, offsetting increases in other categories and causing the overall consumer price index to remain flat during the month.

The national average price for a gallon of gas was $4.01 on Wednesday, according to AAA. That's more than a full dollar less than the recent peak in gas prices of $5.02 during June.

But while consumers have seen some recent relief at the pump, other prices keep rising. So-called "core inflation"—which filters out the more volatile categories of food and fuel prices—continued its upward trajectory in July, climbing by 0.3 percent. That's down from 0.7 percent in June, but the annualized rate of 5.9 percent is still a worryingly high figure.

Mostly, July's inflation data indicate how crucial gas prices are to overall inflation. They affect not just the price you pay to fill up your car, but also the prices of everything that's shipped, trucked, or flown around the world. Transportation services, for example—a category that includes airfares and the costs of maintaining motor vehicles—saw a 0.5 percent decline in prices during July likely due to falling gas prices. Despite that, the same category is still up by 9.2 percent—higher than overall inflation—during the past year.

And despite the easing in July, gas prices are still up by a whopping 44 percent over the past year. Energy prices as a whole are up 32.9 percent.

The big question now is whether inflation has peaked or whether July's slight cooldown is a blip caused by volatile gas prices. Only time will tell. The Federal Reserve hiked interest rates in June and July, and the central bank has indicated it will likely raise rates again in the near future. Higher interest rates signal a benefit to saving rather than spending, which helps pull some excess dollars out of the economy to ease price increases.

Perhaps the biggest sighs of relief on Wednesday morning will be emanating from Congress, where senators have tried to respond to raging inflation by passing a bill called the Inflation Reduction Act that won't actually do anything to ease inflation. Wednesday's report will give lawmakers an opportunity to make it look like they've accomplished something, even if that's not the case.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

I wouldn’t describe it as tumbling down.

Yeah an increase of 8.5% might be lower than an increase of 9.3%, but it’s still an increase.

I am creating eighty North American nation greenbacks per-hr. to finish some web services from home. I actually have not ever thought adore it would even (res-04) realizable but my friend mate got $27k solely in four weeks simply doing this best assignment and conjointly she convinced Maine to avail. Look further details going this web-page.

.

>>>>>>> https://workhere3.blogspot.com/

Down 67 cents a gallon from last month. With some states cutting or eliminating their gas tax.

Only Eric can call that “tumbling.

As a reminder, current (AAA) average is 4.01/gal, a year ago it was 3.17/gal

When Joe Biden was sworn in it was 2.39/gal

Promises made, promises kept.

Remember, remember the eighth of November

Do you have a link supporting that the costs were due to suspended gas taxes? I’ve heard that said, but haven’t seen evidence. It sounds reasonable to me, but I’d like data to post elsewhere.

It’s come down by about a dollar where I am. The state gas tax is still in place. The federal tax can’t account for that price difference alone.

But if that is a cause of the price drop, it has nothing to do with inflation one way or the other.

Is that what we do now? Raise gas prices to high levels, decrease demand, then as they lower as a result to a STILL high price, we use the word ‘tumbling?’ This is why Americans that listen to people like this in the media get duped. Hey! Apples used to be $1.00 and they raised the price to $5.00. But hey, they are only $3.50 now! The price ‘tumbled!’ What a bunch of elites in the leftist media! Time to make it mandatory to teach economics and finance in schools!

Doesn’t “tumbling” just mean a rapid fall? Prices down by a dollar over a month or so seems to fit that pretty well.

A better thing to complain about is people trying to tell us that changes in price of one commodity means that inflation is really lower and all of the other obvious lies about the causes of inflation.

Right now, it might be greeted with sighs of relief.

Because the media is in the bag for the administration.

A wife beater decides to give his wife a break and take Sunday’s ‘off’; while six days of beatings might be considered horrific, ‘…right now, it might be greeted…’

Yes. They think most Americans are economically stupid just because it’s not taught in school. Everything cost too much to drive so demand is down. Of course prices will come down. Wait until they start driving again. And the spending of our tax dollars is out of control! So they are hiring additional IRS agents to come after everybody! When has the IRS only targeted the rich? Never!

Tout the energy-less inflation figure when energy costs more. Tour the energy-included inflation figure when energy costs less.

Surely on your way to a Pulitzer, or maybe the Nobel for fiction. No one ever thought of this one clever trick before you.

Apparently Kommrad Boehm hasn’t been to the grocery store as of late.

https://www.washingtonexaminer.com/news/washington-secrets/food-crisis-inflation-forcing-change-in-eating-habits

You will eat nothing and like it.

Signed the World Economic Forum and the Koch Brothers.

Shrinkflation on the upswing too. I bought a half-gallon of Breyer’s Ice Cream the other day. Turns out I only bought 1.5 quarts for the usual half-gallon look and price. Fun.

Party size of chips is now 14oz. 16oz used to be the normal size. Party size used to be 24-32oz. Unacceptable.

That’s just alignment with no one having friends anymore. Parties ain’t what they used to be and Frito-Lay understands this.

Working in the packaging industry, times like this can be good when customers need to rework their automatic equipment. New parts and new equipment. It never moves the other way.

Today I saw an 11oz can of soda. When mostly water is getting downsized I know we are fucked.

If Reason.com’s benefactor Charles Koch asked me to eat less so that his $68,000,000,000 fortune could reach $70,000,000,000 to $80,000,000,000 I’d gladly do it.

#BillionairesKnowBest

Inflation is 8% and the economy is in a deepening recession. Sorry Robby but no amount of “but it could be worse” makes that look any better or what is happening any less devistating to the country.

And the Congress didn’t pass a bill that will not help inflation. They passed a bill that will make inflation and the economy as a whole worse.

How can anyone even pretend this is good news? Sure I punched you in the face and broke your nose, but I didn’t use a ball bat like I did last month. Things are getting better.

Leftie regime dick-suckers love to always fall back on the old “it could have been worse” counterfactual, because it’s impossible to ever disprove.

By the way, in case people have forgotten because Reason is mostly trying to avoid talking about it, in a couple of days the regime is going to raise taxes in the middle of a recession. And contrary to what the liars in the government/media complex are telling you, taxes will be going up for most taxpayers, not just for corporations and billionaires.

Whatever positive inflationary effects the drop in oil over the last few weeks are probably going to be reversed and then some by this ill-advised, poorly time tax increase coming our way, the latest shitty policy brought to you by the shittiest government in American history.

Since corporate taxes are just passed onto the consumer, the bill raising corporate taxes will raise the price of nearly everything. This is what Democrats call “fighting inflation”.

As I have suggested, inflation will not be gone by November but will be trending in a direction to favor Democrats. Republicans should not sit on their back sides and expect to win.

But the voting preference solidifies earlier than November. A lot of the research shows the sentiment values in July have greater correlation to November results than are in Sep / Oct (and esp. Nov)

And (D) know that, hence the J6, MAL hail marys.

something something gas taxes deferred something artificial price-lowering

An IRS agent will be by shortly to collect your share.

apparently nowadays armed with more than #2 Ticonderogas and green graph paper

In 2022 Representative Matt Gaetz of Florida introduced a bill to disarm the IRS after the agency had drawn public attention for a $700,000 purchase of ammunition.

Go Florida Man!

somebody co-sponsored?

Inflation is a wingnut.com myth. Recession is a wingnut.com myth. This is the best economy ever.

#TemporarilyFillingInForButtplug

What a .gov shill! A Decrease in the Increase is a ‘Fall’.

a California grocery chain just raised everyones pay by $4/hour but then they reduced the hours they work and the Union agreed to this. people are F’ing stupid. I guess this will give them more time to look for a second job but then its hard to have a second job when you never know what hours you are going to work

That is the same logic behind claims of “cuts” in government programs.

It really isn’t. Inflation is expressed as a rate of change in prices. That rate fell (according to one way of calculating it).

Yes, when you are talking about a rate of change, a decrease of the rate of increase is that rate falling.

Yes. There’s basically always inflation as well, there has been 2-3% inflation for decades now. This difference is this is high inflation.

I would agree it’s not super great news, but it is news.

Good news; Comrade Boehm has informed us that you are getting poorer at a slightly slower rate. Behold the glories of Father Biden and Socialism!!

gas prices are still up by a whopping 44 percent over the past year

Obligatory Kinks song

is it Low Budget?

Gallon of Gas (but you got the right album).

I don’t know about y’all, but gas prices are down in my area. Not a media trick, not election propaganda: the numbers on the signs are smaller than they were earlier this year.

Even though inflation and recession still loom, that’s a positive thing for people like commuters, Uber drivers and rural families.

But I guess when Team Blue is in power, fuck those people.

I remember where they were on 1/20/21. Dramatically higher now. I do not give one credit for doubling the price then “reducing” it to only being about 50% or so higher than before.

Hell, the price pretty much tripled in my area from the start of the Biden administration until last month.

Now it’s down 20% from its high point but still more than double what it was before these clowns took over, and I’m supposed to be happy about this?

Gas prices are also down by me, but as far as I can tell the size of the numbers haven’t changed.

I’m happy but when you have 50+ trucks on the road any little bit helps.

But yeah Fuck Team Blue and Red, they voted for the Cares Act in bipartisanship fashion, printing money while shutting down productivity is the recipe for inflation.

“…But yeah Fuck Team Blue and Red, they voted for the Cares Act in bipartisanship fashion,…”

Got a cite for that ‘both sides’ claim?

Not sure what kinda 50+ trucks on the road you have but I drive a Sprinter van which burns diesel and the price has been holding steady at $US5.50. I know there are some trucks that burn gas but the big rigs all burn diesel and have not seen any drop in prices.

Caught him

Does cherry-picking pay a ‘living wage’, lefty shit?

Wait until the new royalty rates kick in for oil and gas leases and they stop releasing oil from the strategic reserve. I’m guessing that’ll happen on November 9th.

Inflation is more like 30%, based on food prices alone, if the government was reporting the true level of inflation we would already be in the middle of a civil war. They have cooked the books on inflation for 50 years or more.

The good news is that prices are back down around 19 or 20 percent from their peak two months ago. The bad news is that they’re still around 56 or 57 higher than they were at the end of 2019 before you left wing assholes wrecked our booming economy we had at the time

INo doubt you think we should be grateful. Rest assured, we aren’t.

Good news comrade, the chocolate ration was only cut 8% this month rather than the expected 10%. Rejoice.

Double plus good

HAHAHAHHAHAHAHAH

Fall to 8.5%, like that’s a good thing. I’m sure the IRA will help push that number up, though!

Without serious deflation, the lower 75% of the income scale are going broke every passing day. If inflation goes to zero, everyone’s purchasing power is already severely diminished. The damage continues every day that people’s wages don’t catch up to the inflated prices.

Cheapest gas here is $5.35/gallon. Can’t wait for midterms.

Good article, though the key question is ‘why did gas prices drop?’ It appears that nasty free market animal called Supply & Demand was the culprit. Demand was down about 9% for the month. That’s a huge amount when you consider how much driving is not optional or malleable. Clearly a lot of people are altering their driving habits in one way or another to contain the hit to their budget that high gas prices have inflicted.

Inflation is an increase in the money supply. Inflation can/will cause an increase in prices of goods. Since the Federal Reserve(FR) was instituted, the value of the dollar has dropped to $0.03. FR has “tried” to hold inflation to 2%, but it has gotten much higher several times. Even at 2%, the dollar’s value will eventually be virtually zero. This is when we’ll see the reintroduction of $1,000.00 bills.

Reason might be onto something…in more normal times, an annual altar boy molestation rate of 8.5 percent would be catastrophic news. Right now, it might be greeted with sighs of relief, especially by the other 91.5 percent of altar boys.

I reason the entire staff are nothing more than apologists for the Democrats.

“Tumbling” MY ASS!

Remember, remember the Eighth of November

Bidenflation and plot

I can think of no reason the Democrat treason

Shouldn’t come to naught.

Earth to Reason- do you copy?

slot machines for free and without registration – an honest game, big wins and a profitable loyalty program. Register at casino volcano official website and earn money by playing slot machines

Tumbling gas prices????? Where is that happening??? Not where I live. We are in the $4.49 range and have been for months. Diesel and heating oil are even more. Not sure where this is happening.

Did he mention that this is still likely the 2nd-highest inflation rate for the “demo”? You know, 18 to 45 year olds. This article is like lipstick on a pig.

I know, I know, it’s a cute pig. And I need sensitivity training.