Four Blue States Scream 'Federalism' and Sue to Stop Changes in Federal Tax Deductions

New York gets salty over new limits because now the rich will know they're being soaked.

Four blue states are actually invoking federalism in a lawsuit attempting to stop the Trump Administration's new tax rules limiting how much state and local taxes people can deduct from their federal filings.

New York, New Jersey, Connecticut, and Maryland are all suing Treasury Secretary Steven Mnuchin and the Internal Revenue Service (IRS) to try to get the United States District Court for the Southern District of New York to invalidate the new $10,000 cap on state and local tax (SALT) deductions, arguing that this new cap is "interfering with the States' sovereign authority to make their own choices about whether and how much to invest in their own residents, businesses, infrastructure, and more—authority that is guaranteed by the Tenth Amendment and foundational principles of federalism."

It may be perplexing to try to figure out how on earth a state can argue its sovereignty is violated when the federal government changes its own deduction rules. After all, New York and the other states are not actually being required to change their tax rates or respond to the deduction change in any way.

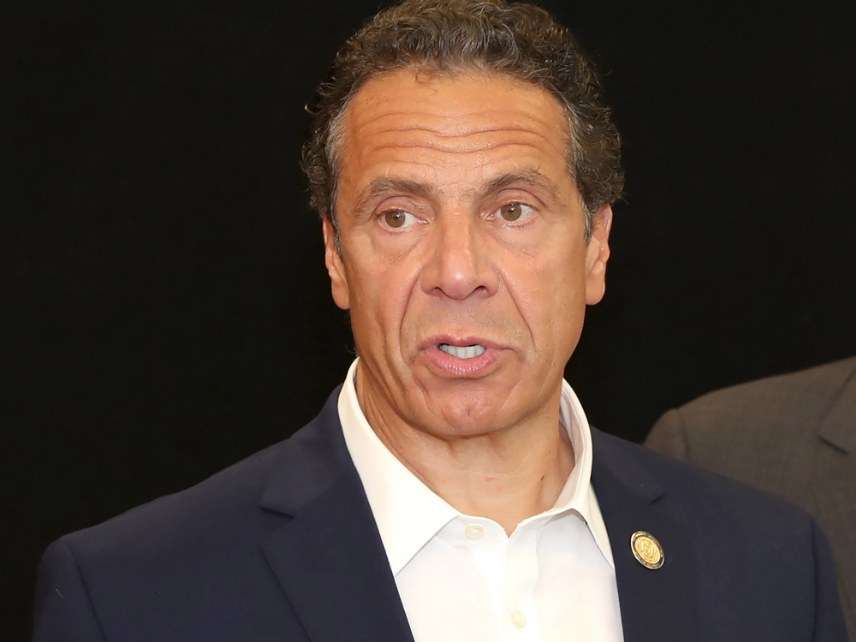

But here's what they're essentially arguing: The reduced SALT deductions don't affect all states equally and that this all has been done to punish "blue" states. As New York Gov. Andrew Cuomo said yesterday, "this is their political attempt to hurt Democratic states. It is totally repugnant and hypocritical of the fundamental conservative ideology which they preach."

The changes don't actually punish states for being heavily Democratic. They do significantly impact states that have high tax rates, which, well, tend to be under Democratic control. They're no longer being shielded from some of the consequences of all these taxes.

So, in a subtle way, there is a kernel of truth here—the change in deduction laws may, as a consequence, force these states to change their tax laws and possibly their state spending. That's part of the nature of the complaint—that this policy "violates" federalism because it results in the federal government trampling all over and distorting state-level tax policy decisions.

There's a fundamental flaw in this argument. It only works if you acknowledge that the deductions themselves as they existed (as far back as the income tax) have always had a distorting effect on state tax decisions. These SALT deductions are not claimed equally across the population. They disproportionately benefit the wealthiest citizens who itemize their taxes. New York calculates that New Yorkers will see a $14.3 billion tax hike without the SALT deductions. But that doesn't mean the hike will be spread across all the citizens of the state. It's those who earn more than $100,000 a year who claim 81 percent of SALT deductions.

As a result, states that have higher concentrations of wealthy people (like New York and Maryland) could raise taxes on their high end and be sheltered from the consequences because of the federal deductions. The "tax the rich" mentality of the politicians of these states didn't scare all the wealthy folks away because they knew they'd be able to take it out of their federal claims.

This, Veronique de Rugy explained last year, means that the existence of the deductions was itself essentially a subsidy to states like New York and New Jersey:

Indeed, the deduction provides an indirect federal subsidy to state and local governments in high-income areas by decreasing the net cost of nonfederal taxes to those who pay them. As the Tax Policy Center notes, in some instances these state and local governments effectively "export a portion of their tax burden to the rest of the nation."

Estimates show that by sheltering state and local taxpayers from the spending decisions of their lawmakers, the deduction encourages anywhere between 2 and 20.5 percent more spending. Not surprisingly, the deduction distorts the financing decisions made by state and local lawmakers. In 2016, for instance, Alaska Gov. Bill Walker cited SALT as instrumental in proposing a hike in income taxes over a hike in the sales tax. He said, "We selected an income tax over a sales tax for a couple of reasons. … State income taxes are deductible from your federal taxes."

Translation: "Thanks to SALT, we can increase your taxes without upsetting you as much as we should." You don't have to be a genius to understand that when taxpayers are less vigilant about policy changes and lawmakers' spending behaviors, we don't get the best policies implemented.

Just ask New Jersey, whose black hole of public employee pension debt keeps getting worse while thousands of retired public employees earn six-figure pensions at taxpayers' expense. That's what they're trying to protect with this lawsuit.

Cuomo complains that it will make New York "less competitive" than other states. You know how to fix that? Lower your tax rates!

Read the lawsuit here.

Show Comments (315)