Tax-Wise, U.S. Just Isn't That Competitive for Business

With tax season upon us, if you were a foreign business owner regarding all of this scurrying around to file forms and pay the United States government its take, would you consider the activity as relatively attractive compared to the alternatives? Or would you consider it a turnoff?

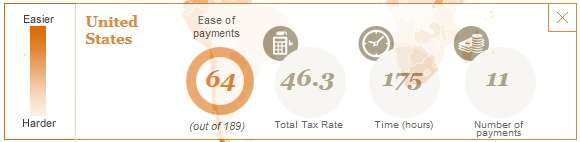

To judge by rankings released last year by the consulting firm PricewaterhouseCoopers (you can call it PwC), businesses may venture into the Land of the Free for market opportunities, but that may well be despite a pretty uncompetitive tax regime. The U.S. ranks 64 out of 189 for ease of paying taxes, has a total tax rate that's above average and, importantly, barely seems to be trying to compete with other countries that Americans once mocked as overtaxed and overgoverned.

According to PwC, "Paying Taxes 2014 looks not only at corporate income tax, but at all of the taxes and mandatory contributions that a domestic medium-size case study company must pay. It considers the full impact of all these taxes in terms of both their tax cost and their compliance burden on business."

In considering the tax hassles faced by its hypothetical company, the report states the average total rate as 43.1 percent, the average hours spent on compliance each year as 268, and the average number of annual payments as 26.7. By comparison, the U.S. imposes a total tax rate of 46.3 percent, and requires 175 hours and 11 payments to comply.

Well, that's how the U.S. stacks up compared to the average. But the average includes garden spots like Zimbabwe and Uzbekistan. How do we compare to the in-crowd?

Err… Well the good news is that the U.S. seems to be improving in many areas, such as compliance time. The bad news is that we're a bit of an also-ran, even in our own neighborhood. Canada, for instance, ranks at 8, has a total tax rate of 24.3 percent, and requires 131 hours and eight payments to comply each year.

Canada has now been in the top ten of the rankings for the last three studies. There are two major factors producing Canada's high ranking for this type of business. First is the significantly reduced corporate income tax rate on the first CAD500,000 of annual Canadian profits made by a privately owned corporation. Second is Canada's sustained effort to simplify electronic reporting, filing and payment, and the tax regulatory and compliance aspects of running a business ('tax red-tape').

Well… Our tax system is more attractive than Mexico's. So we have that going for us.

The United Kingdom is ranked at 14, with a total tax rate of 34 percent, and 110 hours and eight payments required every year.

Australia ranks at 44, with a total tax rate of 47 percent, and 105 hours and 11 payments required every year.

Sweden, the one-time welfare state poster child, but recent convert to free market-ish policies, ranks at 41, with a total tax rate of 52 percent, and 122 hours and 4 payments required every year.

Even France ranks higher than America, offsetting higher taxes (yes, higher than Sweden) with less burdensome compliance requirements.

The U.S. still does better, overall, than China, or Germany (which kill themselves on compliance time), and a business making a go of it in Russia probably worries as much about the local goons as tax environment, but you'd like to think the U.S. could do better.

But then, if you're filing your income taxes, you probably knew the U.S. should be doing better.

Check out the report here and compare your favorite shaded areas on the map here.

Show Comments (25)