More Evidence That Government Policy Was Behind the Mortgage Meltdown

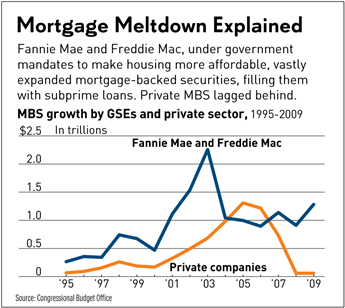

Just two months ago, with regards to the mortgage meltdown that government apologists have been eager to lay at the door of moustache-twirling Wall Street types, a research paper answered the question, "Did the Community Reinvestment Act (CRA) Lead to Risky Lending?" with a resounding, "yes, it did." Now, Investors Business Daily tells us that, as the federal government encouraged ever-riskier loans with fewer and fewer safeguards, the most enthusiastic issuers of the mortgage-backed securities that ultimately crashed in spectacular form were (can you guess?) Fannie Mae and Freddie Mac.

HUD not only encouraged no down payments but also adopted affordable housing mandates for the government-sponsored en terprises that issue mortgage securities, Fannie Mae and Freddie Mac. Beginning in 1996, the [government-sponsored enterprises] had to make 40% of new loans they financed to borrowers with incomes below the national median.

With lower underwriting standards and a mandate to fulfill, Fannie and Freddie's MBS issuance began to take off. It surged more than 116%, from $342 billion in 1997 to $741 billion in 1998.

Hogberg describes how MBS issues soared even as standards for loans were continuously eased, in compliance with the National Homeownership Strategy.

That strategy was a key piece of government policy through two administrations. Of its implementation, then-President Clinton said in 1995 "[t]he goal of this strategy, to boost home ownership to 67.5 percent by the year 2000, would take us to an all-time high."

The "how" of the boost is a big part of what got us into trouble. Businessweek reported in 2008 that the strategy "promoted paper-thin downpayments and pushed for ways to get lenders to give mortgage loans to first-time buyers with shaky financing and incomes."

While the strategy was no secret, and was continued by the Bush administration, it was sufficiently low-profile that the Department of Housing & Urban Development quietly tried to drop the embarrassing thing down the memory hole in 2007. That didn't work.

Hogberg continues:

By 2000, Fannie and Freddie were financing loans with zero down payments. The private market soon followed. By 2006, 30% of all homebuyers made no down payment. …

After those changes, Fannie and Freddie's business skyrocketed. Their MBS issues jumped from about $469 billion in 2000 to $1.1 trillion in 2001. The increase continued, rising to $1.5 trillion in 2002 and $2.2 trillion in 2003. As GSEs' issuance of mortgage securities began to fall in 2004, the private MBS market took up some of the slack. Private issuance rose from $684 billion in 2003 to $980 billion in 2004 to a high of $1.3 trillion in 2005.

Yet private mortgage securities never matched that of the GSEs. From 1995-2009, the private market issued about $6.8 trillion in MBSs vs. $14 trillion for Fannie and Freddie.

I distinctly remember "no-doc" loans being a big deal during those years, too. A friend of mine took out more than one mortgage during the National Homeownership Strategy years without offering a single page of evidence that the income he claimed bore any resemblance to reality. He "self-certified" in the language of the time, in return for a (very) slightly higher rate. He also admitted to me that his claimed income was complete bullshit. He wasn't the only one, as no-doc loans became known as "liar loans" and are now essentially unavailable.

This was a result of federal government policy to promote home ownership as a good in itself without regard to the financial ability to pay for a home. Fannie Mae and Freddie Mac took that policy and turned mortgage-backed securities into the equivalent of torpedoes fired at the U.S. economy.

Show Comments (62)